Mumbai-based venture capital firm Asha Ventures said Thursday it has marked the first close of its maiden fund at $50 million (Rs 416 crore) after securing commitments from a bunch of limited partners including institutional investors.

The impact investor, which has previously backed companies such as Vastu Housing Finance, Varthana Education Finance, Adda247, Truemeds and Nepra, has a target corpus of nearly $100 million for the Asha Ventures Fund-I.

The first close, which allows Asha Ventures to start deploying capital, comes after VCCircle reported earlier this week that the firm brought an onshore institutional investor on board as an LP.

The government-backed Self-Reliant India (SRI) Fund has committed about Rs 100 crore to the fund. Asha Ventures also received commitments from domestic institutions including Small Industries Development Bank of India (SIDBI), a private sector bank as well as family offices of some of India’s top business leaders, it said in a statement.

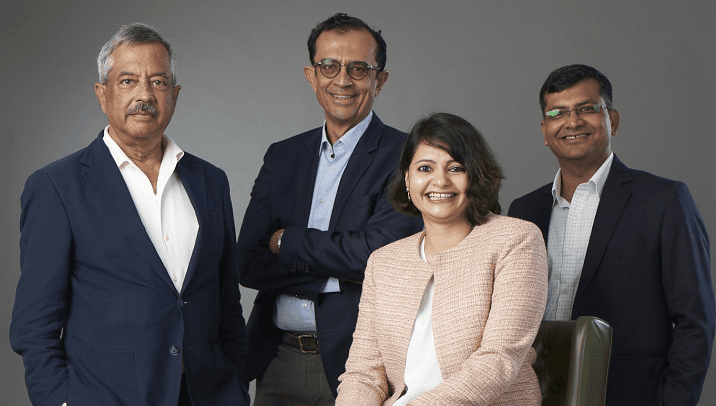

The firm is led by investment banker Vikram Gandhi, former Genpact CEO Pramod Bhasin, former IIFL executive Amit Mehta and Aditi Gupta, who previously was associated with Motilal Oswal.

“At Asha Ventures, we have demonstrated, since 2015, that doing good while doing well is a scalable investment thesis,” Gandhi said. “The backing of reputed institutions like SIDBI, SRI and some of India's largest family offices is a testimony to our track record in this space and gives us a platform to scale up our investments.”

Through the fund, Asha Ventures will invest in early to growth-stage companies that are targeting the emerging middle class. The investments will span across financial services, healthcare, education, climate and agriculture.

“We believe this is the perfect time for technology-led inclusive funding models to be built in India, to fund businesses that are solving for key needs around financial inclusion, healthcare and employability,” said Bhasin. “These markets represent excellent investment opportunities which can create significant impact.”

The fund is aiming to back four-five companies every year as it builds its portfolio, it said.

“India's emerging middle class of 500 million people requires innovative solutions to get access to equitable opportunity. Startups are a key driver of this innovation,” said S Ramann, Chairman and Managing Director of SIDBI. “Asha Ventures has been a pioneer in catalysing domestic capital to back such startups in the inclusion and sustainability space.”