Consumer goods major Hindustan Unilever Ltd (HUL) has decided to sell its rice export business to LT Foods Ltd, a processor and exporter of packaged rice under the flagship brand Daawat.

The Guragon-based company, in a stock market disclosure, said it has entered into an agreement with the FMCG giant to acquire its two top rice brands. “The deal includes the acquisition of brands Gold Seal Indus Valley and Rozana which have been in business for some decades,†LT Foods, owner of Daawat, said in a statement.

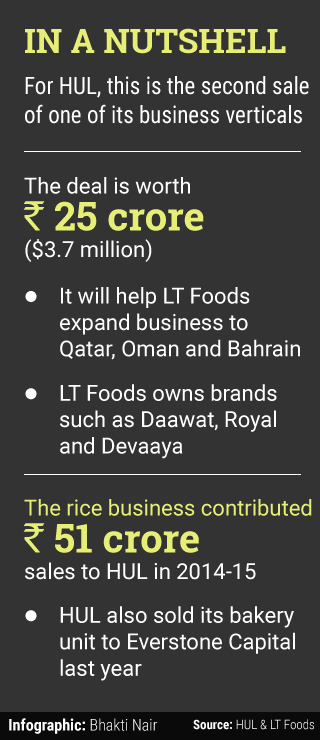

The deal involves transfer of the HUL’s brands and inventory for Rs 25 crore ($3.7 million) to LT Foods.

The company is hopeful that the acquisition will help it foray into the markets of Qatar, Oman and Bahrain, besides strengthening its presence in traditional export bases in the region such as Saudi Arabia, UAE and Kuwait.

“The Middle East accounts for almost 80 per cent of the total basmati consumption in the world. This region is a critical market and our limited presence with only 15 per cent of our revenue coming from the geography is now getting addressed by this acquisition,†said VK Arora, MD at LT Foods.

HUL began exporting premium Basmati rice in 1985 under the brand Gold Seal Indus Valley to various countries in the Middle East and Europe, which was subsequently extended to other brands and geographies. Now it is supplying both the brands to 21 countries across the globe. According to audited financials for 2014-15, the rice business has contributed Rs 51 crore to the annual turnover of the HUL.

Lazard acted as financial advisor to LT Foods for the deal.

Rabo Equity-backed LT Foods has been looking to induct a strategic partner to enhance its expansion plans since 2013.

The company, whose key brands are Daawat, Royal, Devaaya, Heritage, Rozana and Chef’s Secretz, manufactures and exports under three broad verticals: value-added products, organic food and international trading. The export business accounts for 46 per cent of the revenue in 2014-15 for the over five-decade-old company.

The firm had registered a less than 2 per cent growth in terms of revenue for the year ended March 31, 2015. It had clocked revenues of Rs 1,855 crore in financial year 2014-15.

For HUL, this is the second sale of one of its business verticals. Last year, it sold its bakery business to private equity firm Everstone Capital. Though the bakery unit sported good performance both in terms of top-line and bottom-line, the sale was imminent as the business was stuck in a low growth industry due to challenges posed by other breakfast options and low entry rate in the segment.

It also sold one of its real estate properties in 2015. It disposed of a property in Bangalore, which was proposed to be developed as a special economic zone (SEZ), to Brigade Properties Pvt Ltd, a joint venture between Bangalore-based developer Brigade Group and Singapore's sovereign wealth fund GIC.