The government has tabled a bill in parliament that aims to make it easier for companies to wind up failed businesses and bring India on a par with developed nations in terms of resolving bankruptcy issues.

The Insolvency and Bankruptcy Code 2015, introduced on Monday, is one of the most important items on the government’s agenda after the constitutional amendment bill to roll out the Goods and Services Tax.

India currently doesn’t have any one law that deals with insolvency and bankruptcy, ranking the country lower than most nations in this respect.

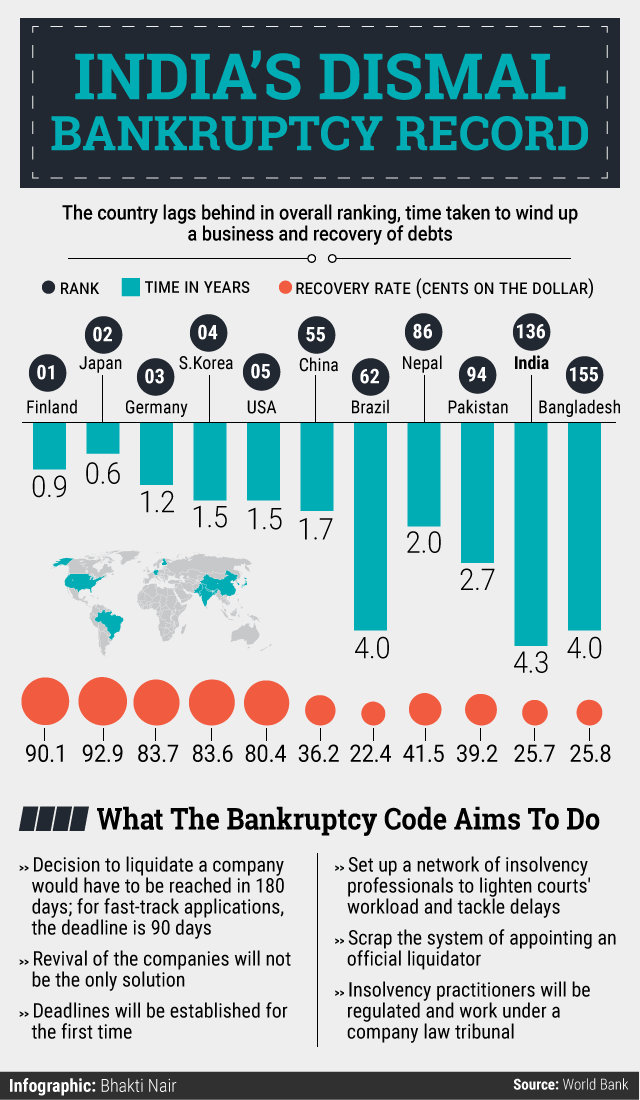

We take a look at how India ranks globally in resolving bankruptcy issues and what will change after the law is put in place:

India is placed 136 in terms of resolving insolvency in a World Bank list of 189 nations. The country also lags behind some of its South Asian counterparts on a few parameters. India, the world’s fastest-growing major economy, takes 4.3 years to resolve insolvency issues while Nepal does it in less than half the time. The new law aims to bring the time down to less than a year, a period that is similar to what countries like Japan take.

The code is also expected to make it easier to do business in India. Besides, the government aims to increase investment and develop a better credit mechanism through the reform.

The bill also aims to improve the average recovery level in India to at least 40 cents on the dollar from about 26 cents currently.

While the GST bill will likely have to wait till the budget session because the government doesn’t have a majority in the Rajya Sabha, the bankruptcy code has a better chance of passage in parliament. This is because the code is a money bill, which needs to be passed by the Lok Sabha and the upper house has limited powers to block it.