Foreigners turned net sellers of Asian equities after three consecutive months of buying as concerns over a resurgence of the coronavirus and a firmer U.S. dollar dimmed demand for riskier assets.

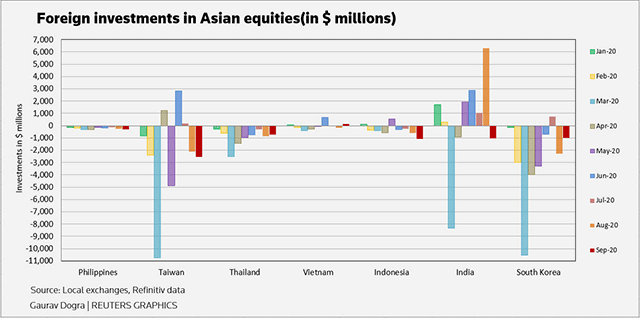

Cross-border investors sold a combined net total of $6.5 billion worth of equities in Indian, Indonesian, Philippine, South Korean, Taiwanese, Thai and Vietnamese stocks in September, data from stock exchanges showed, marking their first monthly net selling since May.

Equity flows into Asia have not really reverted since March, said Frank Benzimra, head of Asia equity strategy at Societe Generale, adding that a correction in U.S. tech stocks and rising concerns over a resurgence of the virus in Europe affected flows last month.

"We need some catalysts, such as a breakthrough in terms of treatment/vaccine for COVID-19, dollar peaking, or some clear signs that the V-shape recovery of 3Q can be sustained into 4Q and beyond," he said.

Paul Sandhu, head of multi-asset quant solutions at BNP Paribas Asset Management, said Asia's better handling of COVID-19 compared with developed markets could lure inflows in coming months.

Tech-reliant South Korea and Taiwanese stocks saw bigger margin of regional outflows, which was triggered by a heavy sell-off in tech stocks in the United States. Taiwan faced $2.5 billon worth of outflows, while South Korea saw $1 billion.

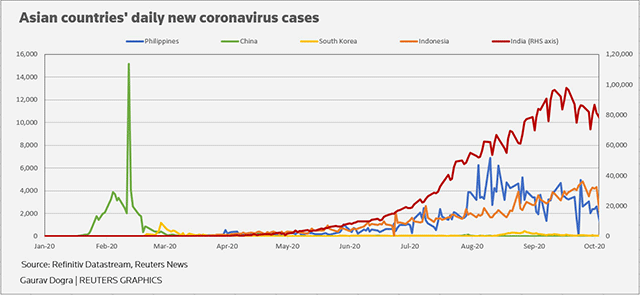

Indian and Indonesian equities faced outflows of $1 billion each due to worries over higher number of COVID-19 cases.

India's tally of cases stood at 6.76 million, as of Wednesday, which was second only to the United States, while Indonesia had at least 0.3 million infections.

Thai and Philippine equities faced outflows of $732 million and $306 million respectively.

Bucking the trend, Vietnamese shares received $135 million worth of inflows as the economy picked up pace in the third quarter, backed by an effective containment of the pandemic.