India digital is driving innovation, scale, and value creation. A large part of India’s Nifty50 will be composed of tech companies being built today, creating the “Tech Nifty50”. We aim to invest in these “Tech Nifty50” companies. Navjot Kaur, Associate Director at Epiq Capital talks about the India positioning today and tech as a key investment opportunity over the coming years.

What is the overall India sentiment today and why?

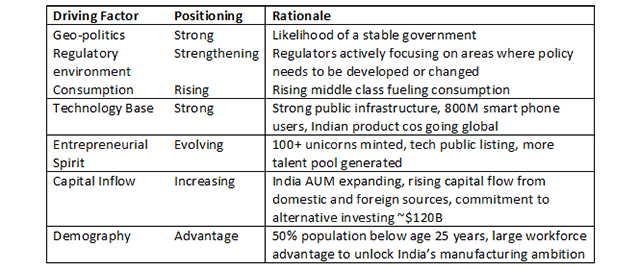

India has always been one year away from greatness. For several years, we have debated in favor of India rising, albeit eventually. However, the rise is happening now. It is visible. Our country is going through systematic changes in multiple key aspects such as geo-politics, regulation, consumption, technology, entrepreneurial spirit, and capital inflow; bolstered by a favorable demography dividend. India is structurally strengthening.

India’s systematic changes reduce failure risks, while converge of multiple strengthening factors create predictable success probabilities. India is at such a position, also being called the “Amrit Kaal” of the country.

How does India stack up globally for investors right now?

India is one of the few emerging markets in the world where the stock market growth has kept pace with the high GDP growth in the country. Unlike China, Singapore or Brazil, India’s economic growth has propelled strong corporate earnings, thus benefiting equity investors in the country. Recently, we crossed Hong Kong, becoming the 4th largest equity market (~$4.33T) globally.

India is a global bright spot and is likely to witness increased foreign capital inflow over the next few years. The burgeoning China+1 effect is already seeing a manufacturing boost in the country and will continue to impact India positively.

What are the shifts in corporate India? Are tech startups playing a role in this?

When we think about startups, we think of young companies scaling quickly. And when we think about publicly listed companies, we often imagine large established organizations. Startups (small, private) and listed stocks (large, public) have been two different asset classes that have largely not overlapped. This is changing.

Indian startup ecosystem was born 10 years back and has now matured. So far, achieving a ‘unicorn’ status has been a growth milestone for a tech enabled startup. However, Indian tech entrepreneurs are looking at milestones beyond value creation of a few billion dollars, to becoming large public listed companies, the “Tech Nifty50” of tomorrow.

This is the digital decade of India. Tech enabled startups have shown high growth and high value creation in every sector including retail, content, entertainment, food (delivery), etc. Hence, the future Nifty50 (large Indian listed companies with a median market capitalization of ~$35B) will have a high composition of the tech companies being built today.

The first set of venture capital backed tech companies have already gone public. Indian public markets have made it clear that profitability trumps growth at all costs. The next set of tech enabled companies are aligning with these learnings and hence are likely to be more successful in the public markets. There are 30-40 tech companies in the IPO pipeline that will go public over the next 5 years in India. These “Tech Nifty50” companies will create a lot of value for investors.

What should be the focus of funds investing in India and how will you capture this India tech opportunity?

Funds should focus on investing in companies that are leveraging technology to create large scale impact. Technology enabled companies targeting a large market and being led by exceptional entrepreneurs will create the “Tech Nifty50” companies by the end of this decade. We are focused on investing in such companies.

At Epiq Capital, we are specifically focused on partnering with exceptional entrepreneurs. We are partners with some of India’s leading tech entrepreneurs such as Peyush Bansal (Lenskart), Mukesh Bansal (Cultfit), Umang Bedi (Dailyhunt & Josh), Sachin Dev Duggal (Builder.ai) and others. We believe exceptional people create exceptional alpha. Tech enabled company led by exceptional entrepreneurs, addressing a large market with a deep product value proposition, high customer obsession and a unique business model are signs of a very large, valuable company. We aim to capture the India tech opportunity by investing in such entrepreneurs and such companies.

In summary, India's current landscape presents a promising terrain for investors. The emergence of "Tech Nifty50" is inevitable. By prioritizing technology and collaborating with visionary entrepreneurs, investors can seize the evolving Indian market and generate substantial value in the future.

No VCCircle/TechCircle journalist was involved in the production of this content.