Mumbai-based early-growth venture capital firm Cactus Venture Partners said Wednesday it has marked the final close of its debut investment vehicle.

The final close of the fund, launched in late 2020, was at Rs 630 crore, the firm said in a statement.

In September, VCCircle had reported that the firm planned to extend the timeline to close the fund till December 2023.

In terms of the limited partner (LP) mix, the fund received 40% of its commitments from international investors and the remaining from domestic sources. The international commitments are predominantly from family offices and high-net-worth individuals (HNIs) in the US, Singapore, the EU, and the UK.

Indian development financial Institutions, such as SIDBI, Self-Reliant India Fund (SRI Fund), and UP Startup Fund backed the fund as well, along with domestic family offices and HNIs.

In an interaction with VCCircle, Rajeev Kalambi, general partner at Cactus Venture, said the fund’s target corpus was Rs 500 crore with a greenshoe option of Rs 250 crore. In 2022, the fund marked its first close at Rs 350 crore ($44 million).

The VC firm is aiming to invest the entire capital in 13-15 companies. With five companies already in its portfolio, it is targeting to make an additional 8-10 investments over the next one-two years. It primarily invests in clean-tech, health-tech, and business-to-business (B2B) software-as-a-service (SaaS) companies in India.

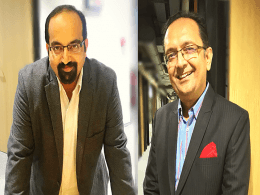

Founded by Amit Sharma, Kalambi and Anurag Goel, Cactus backs companies in Series A and B round, bringing Rs 20-40 crore into each startup. It also seeks to make follow-on investments to maintain its stake in the portfolio companies.

Cactus’ portfolio includes Auric, an Ayurveda-brand targeting millennials; AMPM, a lifestyle brand; and Vitraya Technologies, a B2B SaaS company.

The VC firm has also exited one of its portfolio companies, which found a strategic buyer, and clocked an internal rate of return (IRR) of about 48%, said Sharma.