Higher exports growth, lower gold imports and lower oil imports in 4QFY13 led India’s CAD to swing from an eye-watering 6.5% of GDP in 3QFY13 to 3.6% of GDP in 4QFY13. Going forward, we expect the CAD print for 1QFY14 to breach the 6% mark again due to the front-loading of gold import demand seen in April-May ‘13. However, subsequent quarters are likely to see a narrowing of the CAD owing to: (1) an abatement of gold imports from the record levels seen in Apr-May 2013; and (2) an improvement in exports growth as growth rates in the West improves.

The Event

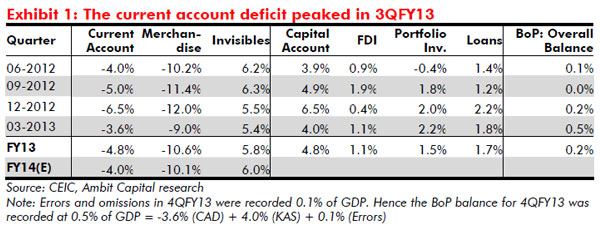

As per the most recent Balance of Payments (BoP) data, India’s current account deficit (CAD) was recorded at an 8 quarter low of 3.6% of GDP in 4QFY13. Simultaneously, India’s capital account surplus (KAS) was recorded at 4.0% of GDP thereby leading the overall balance of payments to be recorded at a surplus of 0.5% of GDP (see exhibit 1 below).

What led to the improvement in the CAD?

A reduction in the trade account deficit was primarily responsible for the reduction in India’s CAD in 4QFY13. A combination of three factors namely: (1) a pick-up in

exports growth, (2) an abatement in gold imports growth, and (3) a slowdown in petroleum imports growth led to this drastic reduction in the trade deficit even as core-imports growth gathered pace.

Consequently the full-year CAD was recorded at 4.8% of GDP i.e. 60bps higher than FY13. This was accompanied by a KAS of equal magnitude thereby resulting in the overall balance of payments account nearly balancing-out (see exhibit 1 above). It is critical to note that a pick-up in FDI inflows in 4QFY13 played a pivotal role in buoying the KAS in FY13.

Where do we go from here?

Going forward, we expect the CAD for 1QFY14 to undergo a substantial deterioration owing to the spurt in gold imports experienced in April-May 2013.

Whilst the CAD print for 1QFY14 is likely to again breach the 6% mark (due to the front-loading of gold demand), subsequent quarters are likely to see a normalization owing to: (1) an abatement of gold imports from the record levels seen in Apr-May 2013; and (2) an improvement in exports growth as the external demand environment improves. Consequently, we re-iterate our expectation of the full year CAD for FY14 being recorded at 4% of GDP in FY14 (refer to our note dated March 18, 2013, for details).

INR likely to experience back-loaded appreciation in FY14

Historically, the net BoP balance has been the most powerful driver of INR movement (i.e. a surplus leads to appreciation and vice versa; refer to our note (Click here for detailed note). For instance the gold import demand driven expansion in the CAD that took place in 1QFY14, coupled with the debt outflows that were triggered by the hawkish commentary from the Fed was responsible for the INR’s depreciation by ~10% over 1QFY14.

Given that FIIs hold about USD30bn of Indian debt and given the extent of outflows experienced over the past 40 days (around $6bn of FII debt outflows), the INR like most other EMs is exposed to the continuance of debt-related outflows.

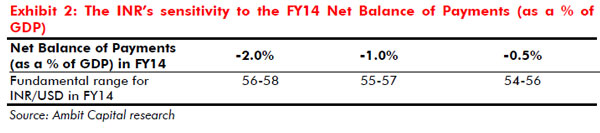

That being said, a regression-based sensitivity analysis of the exchange rate to India’s net Balance of Payments (assuming that a global financial crisis comparable to the Dot-com bubble burst in 2001 or Lehman-collapse in 2008 does not unfold in FY14) suggests that the INR’s vulnerability to a wider than expected net balance of payments is limited (see exhibit 2 below).

Thus even if India’s KAS in FY14 is recorded at 2% of GDP (as opposed to the long term KAS of 3.7% of GDP) as against the expected CAD of 4% of GDP in FY14, as shown by the table above the downside risk to the INR at this point is limited.

In particular, as gold imports growth abates from 2QFY14 onwards, we expect the INR to gather strength and tend towards its intrinsic value.