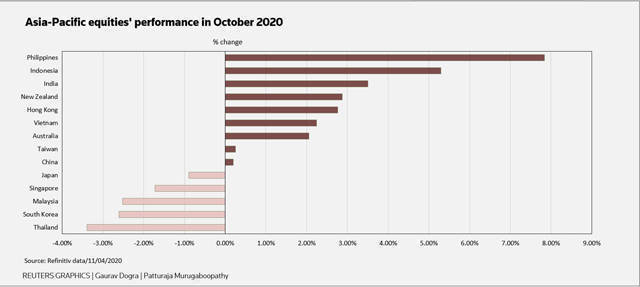

The valuations of Asian shares based on forward earnings dropped to a four-month low in October, boosting the allure of Asian equity markets as the region recovers from the coronavirus pandemic.

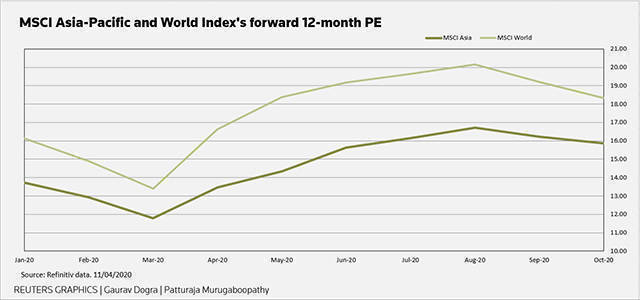

The forward 12-month price-to-earnings ratio (P/E) for MSCI's broadest index of Asia-Pacific shares fell to 15.9 at the end of last month, the lowest since June. That compares with 18.3 for the MSCI World index.

The forward P/E ratio values a stock based on its estimated earnings for the next 12 months, and the ratio falls when analysts project higher growth.

Analysts have raised Asian companies forward 12-month earnings estimates by 1.5% over the past month, with the region witnessing fewer numbers of COVID-19 cases and most of its factories back in full swing.

On the other hand, the United States has seen a surge in infections recently, and some European nations have announced fresh lockdowns to curb the pandemic.

"The combination of improving growth, liquidity and more reasonable valuations provide a favourable macro backdrop to Asian equities. The attractiveness of Asian equities should also favourably impact foreign portfolio flows and Asian currencies," said Sanjay Mathur, Chief Economist at ANZ.

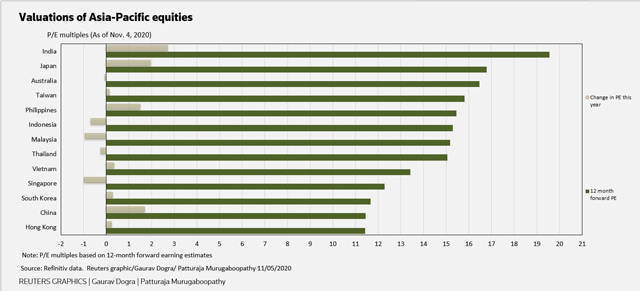

Hong Kong, Chinese and South Korean stocks were the cheapest in the regions with P/E ratios at 11.41 and 11.43 and 11.66 respectively, the data showed.

On the other hand, India, Japan and Australia shares were the most expensive in the region, with P/E ratios of 19.55, 16.77 and 16.45, respectively.

"With many other countries struggling with the resurgence of the virus, we believe capital allocators might find Asian stocks to be attractive at this point, especially if the US dollar gets a bit weaker post-election as expected," said John Lau, the Head of Asian Equities at SEI Investments.

"We see good opportunities for attractively valued stocks in South Korea and Taiwan, as well as India and Vietnam."