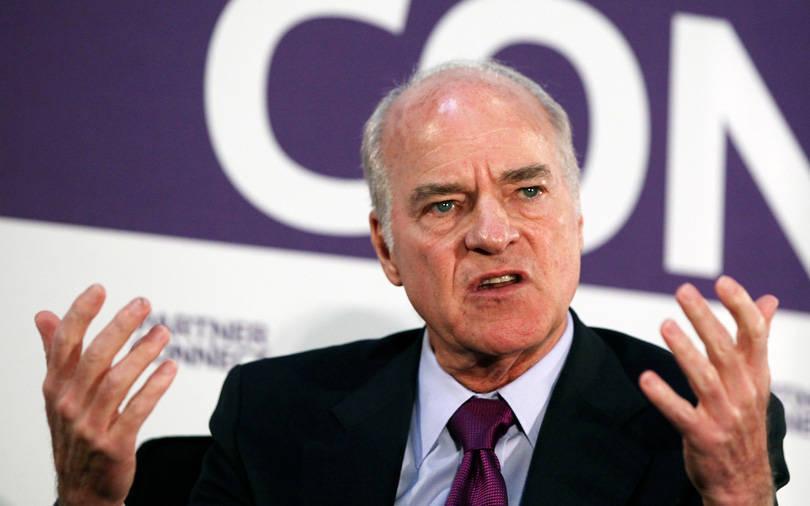

Kohlberg Kravis Roberts & Co (KKR & Co) is focussed on control deals and its credit business in India, the alternative assets giant’s co-chairman and co-chief executive officer Henry Kravis has said.

Kravis, who co-founded KKR four decades ago and started investing in India in 2006, was quoted by media reports as saying that he was bullish on sectors such as waste management, education, IT, food safety, financial services and healthcare.

KKR currently has $195 billion in assets under management globally. In addition to a strong private equity practice, KKR is highly focused on credit, capital markets and real estate opportunities in India. Its key investments in the country include hospital management firm Radiant Life Care and Max Financial Services, the holding company of private insurance firm Max Life Insurance.

Kravis spoke about a wide range of subjects during a roundtable in Mumbai:

Buyout transactions

Kravis said KKR is putting its money in control deals and significant minority investments where they have a say on company affairs, adding that the firm had been trying to do a lot of minority deals very early on.

KKR has struck deals this year to acquire majority stakes in the petrochemicals subsidiary of JBF Industries Ltd and environmental services provider Ramky Enviro Engineers Ltd.

NBFC focus

Kravis also said that KKR will pump more capital into its local non-banking financial company (NBFC) business, which includes KKR India Asset Finance and KKR India Financial Services. One focusses on real estate credit while the other specialises in corporate credit.

KKR has invested more than $7 billion in its credit business in the country and will invest more in the business going forward, Kravis said.

On RBI autonomy

Kravis said that central banks have to be independent and it was not a new phenomenon for governments to exert pressure on them.

His comments were in light of Reserve Bank of India governor Urjit Patel’s recent resignation after friction with the Modi government over the central bank’s autonomy. Kravis pointed out that the US had similar issues on this front.

US-China trade war

India can benefit from the trade tensions between the United States and China, said Kravis. But he also said the country needed to cut back on red-tape to attract more investment.

India rose 23 places to 77th in the World Bank’s Ease of Doing Business Index for 2019, up from 100th in 2018, thanks to improving metrics in areas including access to credit and construction permits.

“As you (India) get better infrastructure, get rid of some of this red tape bureaucracy ... this country will benefit big time,” he said.

Bad banks

Kravis also reiterated the need for bad banks -- a corporate structure for isolating high-risk assets -- as Indian lenders attempt to recover from their bad-loan problems.

“Take the tough medicine, code them as good bank-bad bank, and then cool off the bad loans. Then you have really done a very good asset quality stress test,” Kravis was quoted as saying.

Bond markets

Kravis highlighted the need for a healthy local bond market in India.

“If you don’t have a long-term bond market you limit the growth because you’re putting all the onus back on to the banks to basically be the provider of capital,” he said.

He added that when banks run out of capital or say that they have got to stop lending because of non-performing assets and they are not sure what the RBI wants, mid-size and small companies end up getting “strangled”.

“That’s the reason that we set up our two NBFCs here,” he said.