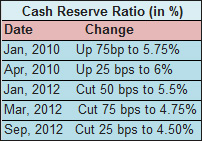

The Reserve Bank of India (RBI) on Monday left the key interest rates unchanged, but cut the cash reserve ratio for banks by 25 basis points to 4.50 per cent. However, the primary focus of monetary policy remains tackling inflation and anchoring the inflationary expectations. The move comes on the back of recent reforms by government that have started to reverse the sentiment.

The central bank has decided to keep the policy repo rate under the liquidity adjustment facility (LAF) unchanged at 8.0 per cent. Consequently, the reverse repo rate under the LAF will remain unchanged at 7.0 per cent, and the marginal standing facility (MSF) rate and the Bank Rate at 9.0 per cent.

State Bank of India Chairman and Managing Director, Pratip Chaudhuri, who had been advocating a CRR cut, said the move would free up to Rs 2,500 crore for the bank.

The bank said its ALCO (Asset Liability Committee) would meet tomorrow to decide if there is any possibility for an interest rate cut on portfolios such as Micro, Small and Medium Enterprises (MSME).

``On consumer segment, our car and home loans are one of the lowest, so there is no possibility we could bring it down further and our growth in the MSME segment is sluggish. So we would look for ways to improve the credit off-take through adjustments in interest rates,” he said in an interview to a channel.

C Rangarajan, Chairman of the Prime Minister's Economic Advisory Council (PMEAC), called the CRR cut as a cautious step by the central bank. “The latest inflation figure is not encouraging. However, recognising that the government has taken some welcoming steps, the central bank has acted and this is the maximum the RBI could have done,’’ he said. The RBI’s next policy stance will depend on how inflation behaves and the apex bank will find it difficult to slash rates if the inflation rises further, he added.

The headline WPI inflation (y-o-y) has remained sticky at around 7.5 per cent throughout the current financial year so far. Core inflation pressures remained firm with non-food manufactured products inflation inching up from 5.1 per cent in April to 5.6 per cent in August.

The headline WPI inflation (y-o-y) has remained sticky at around 7.5 per cent throughout the current financial year so far. Core inflation pressures remained firm with non-food manufactured products inflation inching up from 5.1 per cent in April to 5.6 per cent in August.

“Even as demand pressures moderate, supply constraints and rupee depreciation are imparting pressures on prices, rendering them sticky. International crude prices are vulnerable to being driven up further by global liquidity,” the RBI said in its monetary policy review. It added that the new CPI inflation (y-o-y) remained broadly unchanged in July from June at close to 10 per cent, held up by rising prices of food items.

The central bank expects pressures on the headline inflation in the short-term, despite the recent upward revision in diesel prices and rationalisation of subsidy for LPG.Over the medium-term, however, it will strengthen macroeconomic fundamentals.

Over the longer run, holding down subsidies to under 2 per cent of GDP as indicated in the Union Budget for 2012-13 is crucial to manage demand-side pressures on inflation, the apex bank said.

Rangarajan said that RBI may lay out a road-map for the fiscal consolidation and there are actions being taken for increasing the goods and services, which would further increase the production and address the supply-side constrains.

RK Bakshi, Executive Director, Bank of Baroda, said his bank would not be in a position to cut lending rates unless it is forced to so by its competitors. “However, the CRR cut will benefit us by bringing down the cost of funds by 2 basis points,’’ he said. Experts say banks like SBI are sitting on a huge liquidity through additional SLR holdings, which they would be able to pass on to the customers through a cut in the interest rates. And if it does so, other banks would be forced to follow.

They also said that there are some lending segments which are rate-sensitive such as SME and housing loans. Today’s policy action might bring some relief to smaller borrowers, but there is no real big impact on the larger portfolios that are stalled because of implementation issues.

(Edited by Prem Udayabhanu)