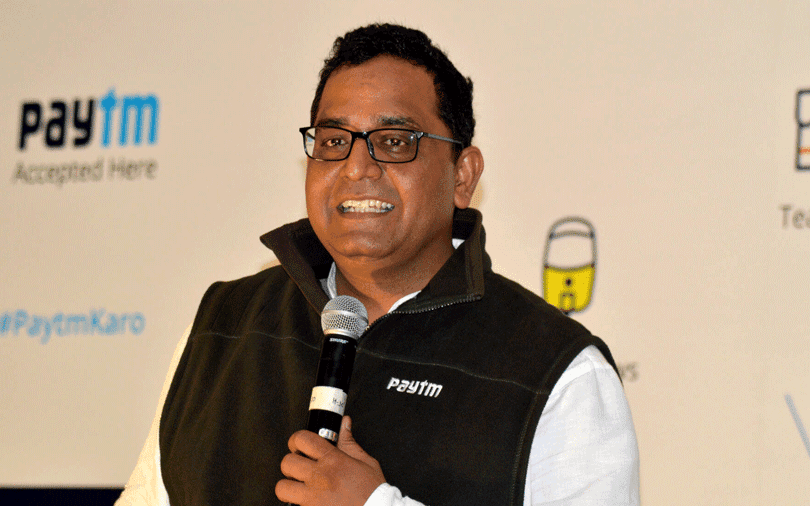

Vijay Shekhar Sharma, who started One97 Communications Ltd., two decades back, is still to come to terms with the thought of his company being one of India’s largest initial public offerings (IPO). He says it's ‘surreal’. One97 Communications Ltd., will be heading towards what is touted to be one of the largest Indian IPOs till date, raising Rs 18,300 crore, with the public issue opening on November 8. In an interaction, Paytm founder Sharma and group chief financial officer, Madhur Deora, talk about what it means to go public, how they envisage different business lines to grow, and the road ahead for Paytm. Edited excerpts:

Sharma: The biggest emotion going through me is how ‘surreal’ it is that Paytm would go public while all of us are sitting at home and not doing this in person. I was worried about what would happen. But I should tell you that there are a number of investors who want to subscribe to our entire anchor portion.

Nobody knew that we would be labeled as the largest IPO in India. In fact, the realisation of even the public listing hit me once I read a newspaper headline. And I was so stoked to see it. And I’m so overwhelmed by the attention and the love we have received in this process. And I wish we as Paytm continue to work harder and this inspires us to do better.

When we look at this milestone, we feel we haven’t done so bad. Internally, we are big critics of ourselves. The only thing now matters to us is how aggressive we play, moving forward.

You were India’s most-valued startup at one point and now are set to become India’s largest IPO. How are you gearing up for the public market scrutiny?

Sharma: We now start a journey of adding more partners to our business. In the private markets, companies have raised much larger rounds than us. We wish we had the opportunity of bringing a larger number of shareholders to Paytm. I wish one day Paytm has millions of shareholders.

Paytm is a purpose-driven organisation and not a money-spinning machine. We have money in the bank and are getting more customers and merchants at lower costs. We are positive that we will attract long term shareholders and investors who will understand that the real value in Paytm is not about quarter-on-quarter profit delivery but on the long term change it brings.

We are here to give anything for a shareholder who is here for the long-term with us. I have put all my gain, commitment and energy into Paytm, all these years.

While the contribution margin of Paytm-owned businesses has grown year-on-year, expenses for the June-ended quarter have also risen. How are you looking at sustainable profitability?

Deora: We want to be efficient in growing our contribution profit, over time. And if we do that Ebidta (Earnings before interest, taxes, depreciation, and amortization) will take care of itself.

Last year we generated Rs 360 crore in contribution profits. This year in the first quarter we clocked Rs 240 crore (in contribution profits), alone. And two years before we did negative Rs 2000 crore (in contribution profits). At this rate, we might land up at a much higher positive rather than in the negative thousands of contribution profits.

Now whether the positive contribution margin goes to the bottom line or for growth functions like technology and people, we will keep that flexibility.

Companies raise much more through private markets, so why did Paytm decide on a public listing?

Deora: Couple of years ago, when we were raising our Series G, Vijay and some of us were discussing whether that would be our last round of funding. And we agreed that it could be if Paytm could build multiple drivers of growth and a clear path to profitability.

Currently, we believe we have that and a clear path to profitability, through the contribution profits that we are registering. And we did it rather quickly, and achieved metrics which are precursors to an IPO.

With newer lines of business including insurance, wealth and lending, how do you see growth impacting profitability or balance sheets?

Sharma: Our business is primarily distribution, where we are a distributor of services created by our financial partners. Every old or new line of business follows the same model within Paytm, where for the first three years it's about finding product market fit, then monetisation, and after three years the focus is on profitability.

Today, wallets or payment services are in the mature stage where they are generating enough revenues. We continue to invest in future bets of credit or insurance, and as they mature, they may become profitable.

Insurance will be in the investment phase for the next three years. For Paytm Money (wealth division), it is in the monetisation phase, and they (Paytm Money) have launched products like stocks and futures and derivatives to name a few. They are cost breaking or even business.

You said you won’t be making further investments in Japan since India is a big opportunity. How are you looking at international expansion then?

Sharma: So international is something we will be focusing on, once we feel the India market is matured enough. We have India’s market to take care of. India will continue to be first for us always.

(Back in 2018, Paytm, run by One 97 Communications Ltd, launched a barcode-based smartphone payment service called PayPay in Japan, in a joint venture with SoftBank Corporation and Yahoo Japan Corporation.)