NeoGrowth Credit Pvt. Ltd, a small and medium enterprises-focused fintech lender, has secured $20 million (around Rs 160 crore) from the United States International Development Finance Corporation (DFC) via the external commercial borrowing (ECB) route.

The funding commitment is for 5 years with a 2-year moratorium on principal payment and will be used for onward lending to SME customers as per ECB guidelines, according to a statement.

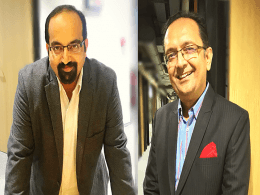

“NeoGrowth is funding India’s small businesses by leveraging the digital ecosystem, and this backing from DFC will help us drive that mission further while also creating a positive impact on SMEs. We will be using these funds to further extend credit to our customers to propel their business growth,” said Arun Nayyar, whole-time director and chief executive officer.

NeoGrowth counts LeapFrog Investments, Quona Capital and Lightrock (formerly Aspada Investments) among its existing investors. NeoGrowth, which doesn’t take deposits, was founded by Dhruv Khaitan and Piyush Khaitan in 2012 after they sold transaction processing firm Venture Infotek.

NeoGrowth has over one lakh customers and disbursed over $1 billion in loans across 25 locations in India.

NeoGrowth had raised debt of ₹120 crore from France’s Proparco SA in 2019. In 2018, it secured equity funding of ₹300 crore in a round led by LeapFrog.

Several startups in the broader fintech space have managed to raise funds despite the broader liquidity crunch.

Consumer neobanking startup Niyo had raised $30 million from homegrown private equity firm Multiples Alternate Asset Management.

Also, credit card startup OneCard’s parent, FPL Technologies had raised $100 million in a Series D round led by Singapore’s Temasek Holdings, making it the latest entrant into the growing club of unicorn startups.

Innoviti Payment Solutions Pvt. Ltd, which runs an eponymous payment-focused financial technology firm, had secured $45 million in its Series D round. It is also the latest fintech startup to get in-principle approval from the Reserve Bank of India for a payment aggregator licence. Fintech firms like Razorpay, Pine Labs, Stripe and 1Pay are also reported to have been granted the licence already.

DFC has been investing actively in India, Recently it invested ₹175 crore ($21 million) in the female hygiene brand Soothe Healthcare Pvt. Ltd.