The pre-IPO hype around Paytm, owned and operated by One97 Communications Ltd, failed to live up to expectations on the listing day of the country’s largest-ever initial public offering (IPO) till date. Paytm's stock plunged almost 27.4% from its issue price, and got locked in the lower circuit. At the close of trading, the market wiped off wealth to the extent of Rs 30,000 crore from its top four investors.

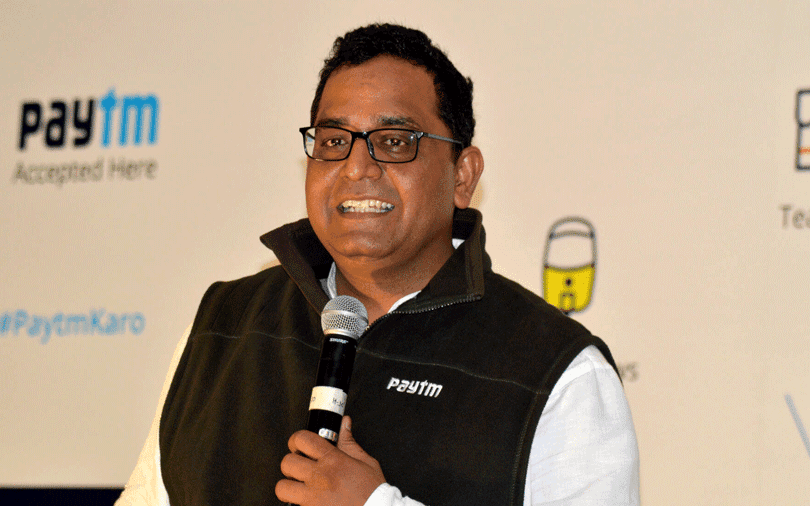

In an interview after the listing, Vijay Shekhar Sharma who founded One97 Communications two decades back, called it a day of learning for Paytm, and has resolved to increase awareness around the company’s business model as the company embarks on a journey of scrutiny from the public markets. Edited excerpts:

One97 Communications Ltd.’s stock price has hit the lower circuit on its listing day. Crores have been eroded from shareholder wealth. Why do you think Indian investors are not buying the Paytm story?

We feel there is tremendous opportunity and Paytm is a new story. India’s stock markets have not seen a similar story yet. We are learning that we need to put in more work to make people and the larger public understand the Paytm story.

In hindsight, do you think that Paytm’s IPO was overpriced and valuations justified?

Look, it’s only day one of trade and it should not be judged as the reference point for Paytm. It’s a new business model and the one learning that we are taking is that we need to explain our business to a much larger audience. As (public) companies we do not decide the pricing, the investors do.

Will One97 Communications do anything different to gain trust of shareholders, especially retail investors?

The biggest and the most important thing to do is to execute on the plan we have spoken about in the past. The one thing that I’ve learnt today is that in the private markets you talk to a smaller set of investors, however you talk to a higher magnitude of investors in the public markets. The beauty about Paytm’s business model is that we can bring the customer acquisition cost (CAC) to a certain ratio of the payments business, and then (later) cross sell and upsell financial services to them. That is the upside of Paytm where CAC remains of payments and we enjoy margins of financial services. That will be reflected in the quarterly announcements and I’m sure investors will get confident. I’m not a trader myself. But today, I realise how big a business opportunity Paytm Money and trading can be, and what a large opportunity lies for it.

What are some of the learnings that you received from your investor roadshows? Can we expect those learnings to yield into newer lines of business?

During our roadshows, we learnt that public market investors can also invest for the long-haul. And they have all been a strong supporter of our purpose at Paytm. And businesses have to be fairly led by fundamentals.

You call Elevation Capital’s Ravi Adusumalli your co-founder. He has been one of your first and longest-backing investor. What advice has he given you?

Well, he has always told me that there are different times for chasing different things. And that now, it is our time to chase monetisation and revenue growth. We will be focused on that.

How does it feel to be a CEO of a public company? Does it feel surreal?

It has been an emotional day. Who would have thought a young company which has no pedigree and no background could reach this milestone (of going public). This has been the expectation of every entrepreneur and of every team. And in some way on behalf of every young company in India today, we said a ‘Hello’ to the stock exchange. We believe we have a larger responsibility and significant amount of execution to do moving forward. Today, I should recommit to listing more companies in India. India has the opportunity to become the second largest (public) market in the world.

You were in tears, earlier today, at the start of your listing ceremony speech. What were the emotions running through you?

There was the Indian national anthem played, and I don’t know why everytime I hear the words ‘Bharat Bhagya Vidhata’ it hits me. This is because I feel this is my purpose and Paytm’s purpose. And when I heard the words from the national anthem a few minutes back, it made me really emotional.