When I was invested in an asset-light chain of day-care surgery centers in India, investors were giving a premium valuation to asset-light business models as those provided high Returns on Capital Employed (ROCE).

The investors in a race to acquire Fortis Healthcare Ltd are looking to fund the hospital chain’s acquisition of Religare Health Trust (RHT), a Singapore REIT vehicle, at premium valuations. Why this googly?

As India’s first dedicated healthcare infrastructure fund, Toro Finserve LLP believes that investors and the Street are blindsided by what is coming!

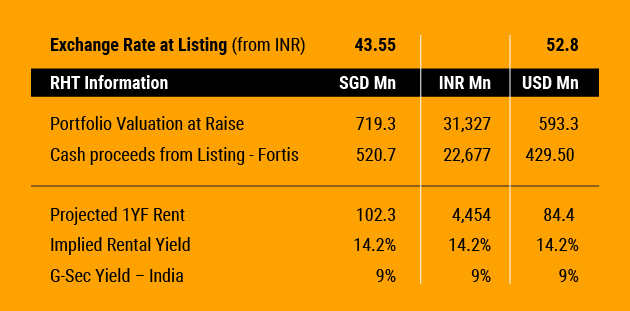

In 2012, Fortis announced spinning off its hospitals (operational and greenfield) into RHT. Fortis raised Rs 2,260 crore by listing RHT, retaining an about 28% stake in RHT. As per Fortis, the rationale for floating RHT was to use it as a long-term finance vehicle, deleverage teh balance sheet, allow Fortis to focus on its core activity of providing healthcare services. Fortis used a majority of the proceeds to repay debt (about Rs 1,350 crore) and invest in its subsidiaries.

Fortis agreed to pay a fixed plus variable hospital service fee (rent) as consideration to RHT. In November 2017, Fortis announced its plan to re-acquire hospitals of RHT for Rs 4,650 crore. As per Fortis, the acquisition of hospitals was to improve its balance sheet, increase profitability by eliminating the service fee and consolidate its business for better valuation by raising equity and debt.

There is something amiss. Let’s take each reason point by point:

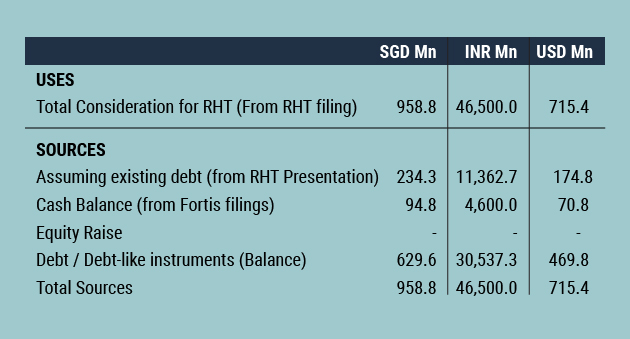

Improving balance sheet: Fortis’ acquisition by any of its suitors may require multiple regulatory approvals. There is also a pre-condition that Fortis acquires RHT’s hospitals first and receive equity infusion from its acquirers. In that case, the following financing option will prevail:

As of 31 December 2017, Fortis’ net debt to equity was 17.8%, (gross debt was Rs 1,799 crore and cash reserves Rs 460 crore). After the transaction, there will be a significant increase in debt from Rs 1,799 crore to Rs 5,989 crore. This includes current debt, new debt and assumed debt from RHT. This should be a huge concern to investors as the balance sheet worsens significantly.

What happens when new investors infuse equity? The new investors are expected to infuse only Rs 1,500 crore to Rs 2,000 crore in equity, thus diluting existing investors’ equity. The rest of the transaction will be financed by debt. Therefore, in the best-case scenario, the debt increases to Rs 4,449 crore, worsening the balance sheet.

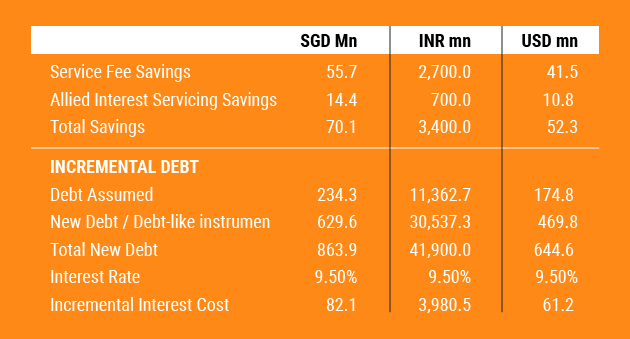

Improving profitability: One might argue so what if the debt increases. Profitability and the asset value also increase, one might say. On profitability, Fortis maintained it can save Rs 270 crore on an annualised basis and allied interest of Rs 70 crore. But it also needs to service the capital it will raise to acquire the hospitals. And assuming debt at an interest rate of 9.5% per year against the hospitals they acquire, Fortis will have to pay an incremental interest of Rs 398 crore (Rs 58 crore higher than service fee savings).

Fortis will be worse off on profit-after-tax basis after acquiring RHT hospitals. So, the argument doesn’t hold that incremental debt servicing may not be as much when new investors infuse equity.

However, equity infusion is not free! Current investors will definitely have to dilute their stake in Fortis for new equity infusion. This is more expensive than taking on debt and, again, is not a great outcome for existing Fortis investors.

Street analysts believe that Fortis listed RHT at about 14% rental yield in 2012, which was expensive and hence Fortis needs to unwind this deal, increasing profitability. These analysts forget that Indian 10-year government securities in 2012 were trading at about 9% and that some of the hospitals transferred to RHT were not stabilised or were under development and warranted higher yields.

Today, to unwind that deal they want to buy the hospitals at 7.3% rental yield (Rs 340 crore/Rs 4,650 crore) when the Indian interest rates have bottomed out. This is nothing but a perfect case of ‘Buy High and Sell Low’.

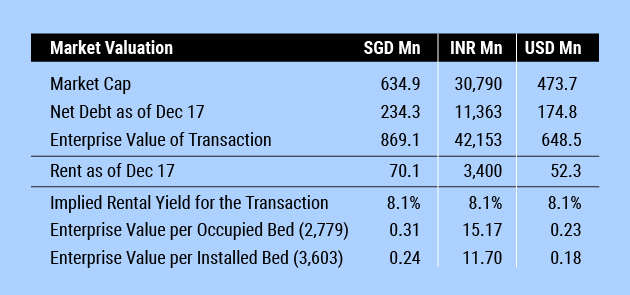

Consolidate holdings for better valuation: Fortis maintains that, by acquiring RHT hospitals for Rs 4,650 crore, the valuation impact will be higher than the original purchase value. It means either RHT is not being priced correctly in Singapore or Fortis can find certain “synergies†to justify valuation.

Clearly, there is no case for synergies here and the current enterprise value of RHT of about Rs 4,215 crore at approximately 8.1% rental yield in Singapore is fair if not marginally high. Fortis is paying a premium of about 10% to buy the hospitals at a rental yield of about 7.3% for Rs 4,650 crore, which is very expensive.

Why does Fortis believe it can get a better valuation? Street analysts told us that earnings before interest, tax, depreciation and amortization (EBITDA) will improve by Rs 340 crore (service fee saving) while the cost of acquisition is below EBITDA.

Applying industry-wide EBITDA multiple of 20 times should increase the valuation to Rs 6,800 crore whereas Fortis is only paying Rs 4,650 crore for the hospitals. We are aghast at this view, assuming that investors don’t understand what they are buying for the investment they have made.

In reality, the Street is valuing hospitals at Rs 6,800 crore i.e. at 5% rental yield (Rs 340 crore/Rs 6,800 crore) when the actual value is Rs 4,215 Crore at 8.1% yield (discussed above). So a premium of about Rs 2,600 crore is being achieved by simply changing ownership of hospitals. How easy!

The Street is failing to see how this transaction negatively impacts the balance sheet: with increased leverage, profitability is getting worse as there is no real service fee savings against incremental interest payments to be paid by Fortis and valuation improvement is nothing but betting on investor’s irrationality.

Contrary to the Street’s view, the transaction is being closed not for sound financial reasons but for other qualitative factors that are not articulated. Let’s understand, Indian healthcare companies trade at highest multiples in the world and are one of the most expensive propositions from international investors’ perspective.

Moving forward, the Street’s notion of valuing Indian healthcare, with healthcare REITs in India, needs to shift. Else, risk capital will be scarce to come by for Indian healthcare operators.

Update: On 31 May, Fortis Healthcare informed stock exchanges that a wholly owned unit, Fortis Healthcare International Ltd, had sold 18.2 million units of Religare Health Trust for SGD 13.65 million, that is at SGD 0.75 per unit, to Mahesh Udhav Buxani (12.2 million units) and Splendid Asia Macro Fund (6 million units).

Why would Fortis Healthcare sell units of RHT to third parties when it has entered into a definitive agreement to acquire all the outstanding units of RHT at a significant premium over it’s listed price and the above transaction price? How does that make sense? What are we missing here?

Additionally, a quick web search revealed that Buxani also holds 1.91% of Religare Enterprises Ltd, a related company of the erstwhile promoters of Fortis Healthcare! The transaction is classified in the filings as non-related party transaction, but is it really?

Kapil Khandelwal and Tapan Bhatt are managing partners at healthcare infrastructure fund Toro Finserve.

*This article has been updated to add information about Fortis Healthcare selling units of Religare Health Trust.

Like this column? Sign up for our daily newsletter to get our top reports.