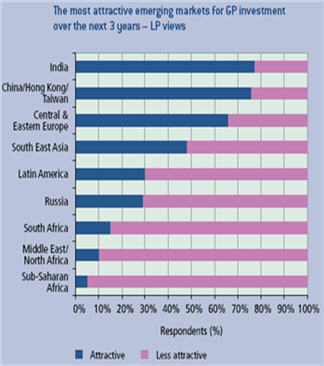

Limited Partners' (LPs) think India will offer the most attractive investment opportunities for GPs over the next three years, according to Coller Capital's latest Global Private Equity Barometer, a survey which captured the views of institutional investor in 102 private equity investors around the world.

India is followed by China and the developed economies of Japan and Australia in the preference list for emerging markets.

However, investors recognise a paradox in their collective hunger for Asia-Pacific private equity, as over three quarters believe the ready availability of capital is making it too easy for weak GPs (General Partners) to raise funds in the region.

Investment in private equity funds targeting the Middle East will also grow. Despite perceiving significant barriers to investment in the region, the survey found that about 20-30% of LPs plan venture into Middle East private equity over the next three years. A negligible proportion have commitments there today.

Talking of the current economic scenario which has also deterred private equity, the barometer revealed that the globalisation of private equity will not be slowed by recession or the credit crunch.

However, it cautioned against stretched allocations and shortage of cash, and revealed that two thirds of private equity investors (LPs) will have little or no 'headroom' for new fund commitments by this time next year. North American LPs will be particularly stretched -- 28% of them expect to be over their allocations by December 2009.

Yet investor commitment to private equity as an asset class has not wavered, finds the report. The vast majority of LPs (97%) will maintain or increase their allocations to private equity, and 40% of LPs plan an increased allocation -- a proportion unchanged since the boom years. Neither have investors' return expectations for the medium term changed -- 43% of LPs still expect net annual returns of 16%+ over the next 3-5 years.

The survey said that the problem for investors is not appetite, but stretched allocations and liquidity needs which will result in a shift towards quality GP's and portfolio re-balancing driving secondary sales. See the full report here.