We started 2019 with hopes for a revival in the healthcare and life sciences sector globally. But the BSE Healthcare Index has fallen about 4%. This is a public market indicator of investment activity in the sector. However, private-market activity has been more positive. So, what is the outlook for 2020?

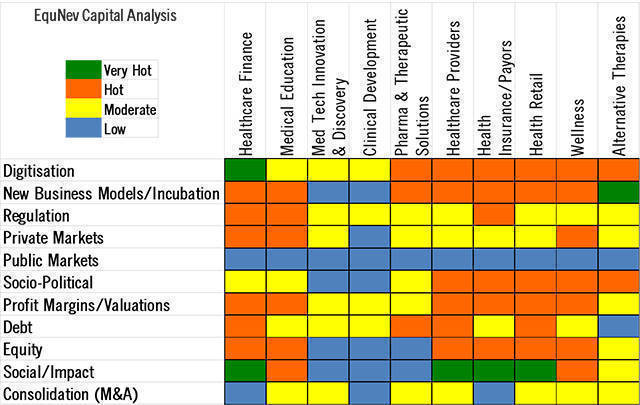

Our investment heat map for 2020 shows activity slowing down across the healthcare and life sciences sub-sectors. This year’s outlook includes the social finance segment, factoring in the Social Stock Exchange regulations which would be passed early 2020.

Dreams on

As compared to 2019, the heat map for 2020 is muted on account of the slowdown in the Indian economy, delays in reforms and weak consumer sentiment.

The first half of 2019 had a muted investment climate due to the general elections. The only decibel was the launch of Ayushman Bharat. The second half of 2019 was negative due to economic uncertainties.

However, 2020 will be neutral due to weak consumer confidence and spending slowdown affecting the growth, margins and valuations of the sector.

Based on the heat map, the 2020 outlook portrays a different micro-sector perception. Let’s look at the broad trends for 2020 in terms of investment activity and trends.

Healthcare financing

As the ‘India Stack’ builds up to bring the next 500 million people into its fold, consumer financing of healthcare events will attract many operators leveraging fintech tools. Many new players are entering this segment and plan to provide innovative products and services, thus increasing coverage in 2020. However, new players are expected to squeeze the margins. Expect social/impact business models to emerge.

- 2020 Outlook: Hot

- What’s going wrong: Regulation, maturity to scale, muted/delaying of consumer spending

- What’s going right: India Stack digitisation, consumer borrowing to spend on electives, social stock exchange

Medical education

The regulatory regime to open up different skills for healthcare is still playing catch up. Healthcare could be the key job creator. Regulatory reforms are urgently required to push investments and activity. Many debt-servicing issues will still persist in 2020 with a few bankruptcy cases hopefully being resolved.

- 2020 Outlook: Moderate

- What’s going wrong: Regulation, corruption, no vision, skill shortages, alignment to new-age care, increasing debt burden, new-age skills certification

- What’s going right: Skill demand, NCLT closures

Med-tech innovation, life sciences discovery and clinical development

The pipeline for moving into clinical development in 2020 is not very encouraging and of investment grade. On the clinical development front, there is status quo from 2019.

Investments will be muted. Social innovation would be the way forward.

- 2020 Outlook: Medium

- What’s going wrong: Innovation pipeline, intellectual property regulation, regulatory bottlenecks on clinical development

- What’s going right: Talent supply, cost advantage, emerging social innovation models

Pharmaceutical and therapeutic solutions

The story of 2019 will continue. Not much M&A consolidation activity is expected. Digitisation will be a key driver in 2020. Mega investment rounds of some e-pharmacies will lead to some competitive activity to gain market share. Some social impact models to counter the bottom-of-pyramid need gaps are emerging. It will not get mainstream in 2020.

- 2020 Outlook: Moderate

- What’s going wrong: Price controls, policy logjam

- What’s going right: Cost advantage, distribution infrastructure, digital business models

Healthcare providers

Funding and liquidity crisis will continue. Expectations of a few innovative delivery models to emerge as costs build up and prices will remain under pressure. Ayushman Bharat will consolidate, leaving behind capacity build-up lags. Social business models will emerge on the back of the social financing tap being opened up. There will be no major action on public-private-partnership front.

- 2020 Outlook: Moderate

- What’s going wrong: Margin pressures, price controls, GST slabs rationalization on inputs, execution of programs on the ground, PPP in healthcare

- What’s going right: Ayushman Bharat, Jan Aushadhi, Social Stock Exchange

Healthcare insurance

Expect to see some innovative models for healthcare payers emerge in India for the middle of 500 million that are paying out of pocket. As loss ratios will mount, the insurance rate will go northwards. Innovative products and pricing still a distant reality with the regulator in India.

- 2020 Outlook: Low

- What’s going wrong: Margin pressures, product fit to consumer needs, product approvals, loss ratios

- What’s going right: Consumer demand

Health retail

Muted consumer demand and discretionary spending due to disposable income growth will result in slower growth and pick-up in gross merchandise value. Valuations will be a key issue. Consolidation and acquisitions are expected for some to survive and grow. VC and PE interest is getting tempered down.

- 2020 Outlook: Moderate

- What’s going wrong: Regulation, maturity to scale, slower consumer demand

- What’s going right: India Stack digitisation

Wellness

The Fit India movement will stay in 2020 and beyond. Discretionary consumer spending on wellness is yet to pick up. Mass market moderately priced wellness products and business model innovation is still lagging behind. Revival in growth is expected only after the third quarter in 2020.

- 2020 Outlook: Moderate

- What’s going wrong: Regulation, maturity to scale, new mass-market business models

- What’s going right: India Stack digitisation, Fit India

Alternative therapies

Alternative therapies are still lagging behind. Multinational companies and local businesses have entered in this segment affecting their market share and position. Consumer adoption will continue, albeit slowly than before in 2020.

- 2020 Outlook: Moderate

- What’s going wrong: Maturity to scale, consumer education

- What’s going right: India Stack digitisation, consumer spending on health and wellness

Kapil Khandelwal is managing partner at healthcare infrastructure fund Toro Finserve LLP and director at EquNev Capital Pvt Ltd.