The Direct Taxes Code Bill, 2009 (‘Code’) unveiled on August 12, 2009 is a bold attempt to create a robust tax system in India. The Code, open for public comments, is expected to be implemented from April 1, 2011.

This article deals with the salient features of the Code from an M&A perspective. Reference to the Act in this article indicates the current provisions as contained in the Income-tax Act, 1961.

Sale of assets

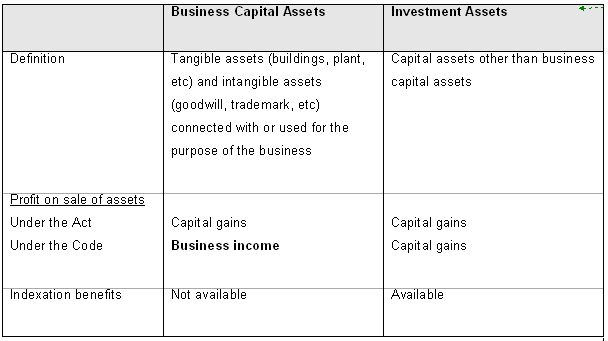

Capital assets have been classified into two categories - business capital assets and investment assets. While the tax rate for income from sale of both the categories is identical (except for capital gains in case of non residents), some key differences are tabulated below:

Other key features of the Code are:

No distinction between long term and short term capital gains. The period of holding is relevant only for ascertaining the indexation and rollover benefits.

Abolition of the Securities Transaction Tax regime. In line with this, capital gains arising from sale of listed shares will henceforth be treated on par with sale of unlisted shares.

Base year for calculation of capitals gain tax has been shifted to April 1, 2000 from April 1, 1981. As a result, notional gains earned but unrealized till April 1, 2000 will effectively be tax exempt.

Cost of acquisition / improvement to be deemed as ‘NIL’ in all cases where the same is indeterminable.

Slump sale

Profit on sale of an undertaking (slump sale) is also considered as business income under the Code. While the consideration is to be credited to gross earnings, the “net worth’ of the undertaking (the term will be defined once the Rules are published under the Code) will be allowed as a deduction. This is similar to the existing provisions, except that the difference between the consideration and net worth is chargeable to capital gains tax under the Act.

It is interesting to note that the commentary attached with the Code indicates that the loss on sale of the business capital asset will be treated as an intangible asset for which deduction would be allowed on a deferred basis. The deferment of loss is intended to serve as a disincentive for asset stripping and loss manipulation. However, since, the gross consideration and net worth are to be added to the gross earnings and deductions respectively while computing the taxable income, it appears that the loss incurred on sale of the undertaking should also be fully allowed in the year of sale itself. Thus, the dichotomy between the commentary and the provisions will need to be resolved.

The Code also provides that the tax base of the assets in the hands of the buyer would be the tax base in the hands of the seller. Presently, under the Act, the buyer of an undertaking in a slump sale allocates the consideration to the assets (tangible and intangible) at their fair values and claims depreciation accordingly. Hence, after the Code comes into effect, the buyer will not get any tax breaks for the enhanced amount paid for acquisition of the undertaking. The notional written down value of the assets will get reduced for computing the value of the block of assets in the hands of the seller.

Business reorganisation

Business reorganisation includes amalgamation and demerger. The provisions are largely similar to the provisions contained in the Act and provide for tax neutrality in the hands of the transferor and transferee entities and their shareholders / partners / proprietors. However, the key differences are summarized below:

- The Code envisages, subject to compliance with specified conditions, amalgamation of unincorporated bodies such as firms and proprietary concerns into companies;

- The successor, is entitled to carry forward business losses of the predecessor, in a manner similar to that presently applicable under the Act, except for the following key differences:

– The test of continuity of business, which was prescribed under the Act only in the case of an amalgamation of a company has also been extended to include demerger;

– Under the Act, in an amalgamation, the losses could be carried forward only if the predecessor owned an industrial undertaking / hotel / ship. The Code does not stipulate any such restriction;

- Expenses incurred in connection with business reorganisation are allowed as a deduction under the Act over a 5 year period on a straight line basis. Under the Code, for companies, such expenditure would be deductible @ 25% on a written down value basis. For other entities, the entire expenditure would be allowed fully in the year in which it is incurred.

(Amit Jain is Partner, BMR Advisors. The views are personal. Ketan Malkan contributed to the article.)