Foreign investors were net buyers of Asian shares for a second straight month, helped by a recovery in regional economic activity and a surge in demand for technology shares.

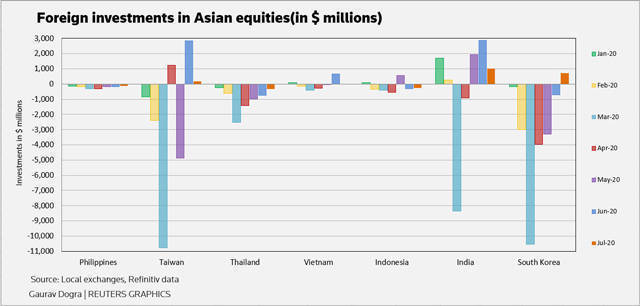

Overseas investors bought a net $1.2 billion worth of regional equities last month, compared with a $4.4 billion in June, data from stock exchanges in India, Indonesia, the Philippines, South Korea, Taiwan, Thailand and Vietnam showed.

MSCI's broadest index of Asia-Pacific shares rose 4.29% last month, thanks to a 12.8% surge in technology shares.

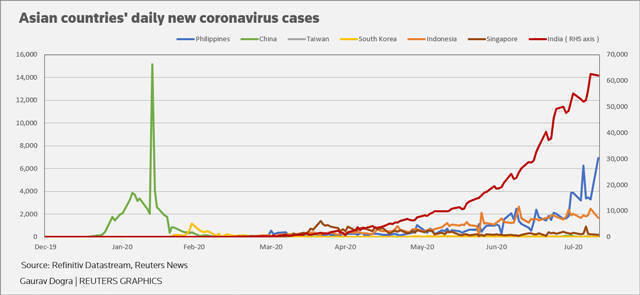

"Ample global liquidity, a recovery in Asia's growth pulse and a broadly contained pandemic situation in the region have supported the inflows," said Khoon Goh, head of Asia research at ANZ, in a note.

"The weaker USD has also been supportive of Asian asset prices."

Tech reliant South Korean equities received a net $725.6 million in inflows last month, while Taiwanese shares attracted $189.39 million worth of foreign money.

Indian shares saw an inflow of $1.02 billion, the highest in the region, despite concerns over a surge in COVID-19 cases.

On the other hand, Thailand shares recorded outflows worth $315.3 million in June, marking the eleventh straight month of net foreign selling, while the Philippines witnessed its ninth consecutive outflow of $124 million.

In the Philippines, infections surged nearly seven-fold to more than 136,000, while deaths more than doubled since the lockdown was lifted in June, prompting authorities to reimpose curbs in and around Manila last week.

Indonesian and Vietnamese shares also faced some outflows last month.

"We are seeing a mixed picture," said Jingyi Pan, a Singapore-based market strategist at financial services firm IG.

"Broadly, Asia markets outside of China are expected to see recovery improve into the end of year that may find investors cautiously returning to the market."