Yes Bank today singed a pact with OPIC, an arm of the US government's development finance institution, for USD 220 million (about Rs 1,350 crore) loan for on-lending to micro, small and medium enterprises.

The loan to the private sector lender is part of the USD 1 billion OPIC assistance for India, announced by President Barack Obama at the India-US Business Summit yesterday. The loan is for 12 years and the bank will draw it one go.

"Specifically, USD 100 million of the financing would be used to support either micro-SMEs or SMEs in underserved rural and urban markets. The agreement underscores OPIC's commitment to growing the small and medium business sector in India" Yes Bank said in a statement.

Overall, the MSME sector contributes about 40 per cent to India's exports, and contributes about 35 pet cent to the country's GDP.

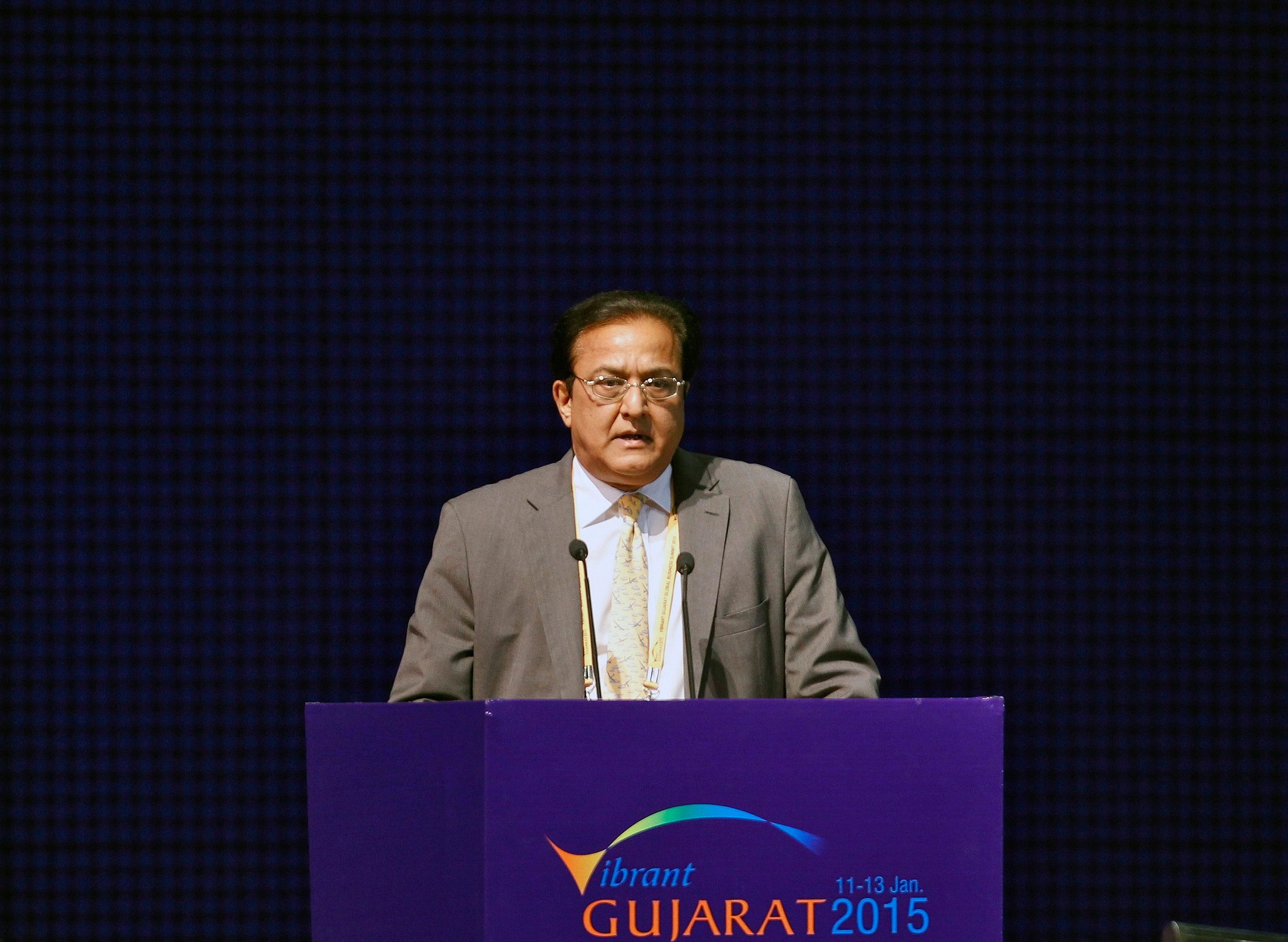

"It is a very meaningful agreement," said Yes Bank MD and CEO Rana Kapoor during the signing of the Memorandum of Understanding.

"This deal will also allow us to go into the underserved areas and to go into urban areas. This will be a very important part of our deliverables," he added.

The US based lender Wells Fargo Bank will act as a sponsor and co-lender to the project.

The MoU was signed by Overseas Private Investment Corporation (OPIC) President and CEO Elizabeth Littlefield and Kapoor.

"We are excited to announce our partnership with Yes Bank in anticipation of the economic growth it will spur," said Littlefield.

US Ambassador to India Richard Rahul Verma said: "This is consistent with what the President said about what we can do for the ordinary people."

OPIC mobilises private capital to help solve critical development challenges -- a part of the US foreign policy. It helps the US business gain footholds in emerging markets, catalysing revenues, jobs, and growth opportunities.

As per a World Bank estimate, the viable and addressable demand for MSME lending in India debt surpasses supply by USD 48 billion.

This gap is particularly pronounced in India?s low income states, where approximately two-thirds of the MSME debt gap resides.