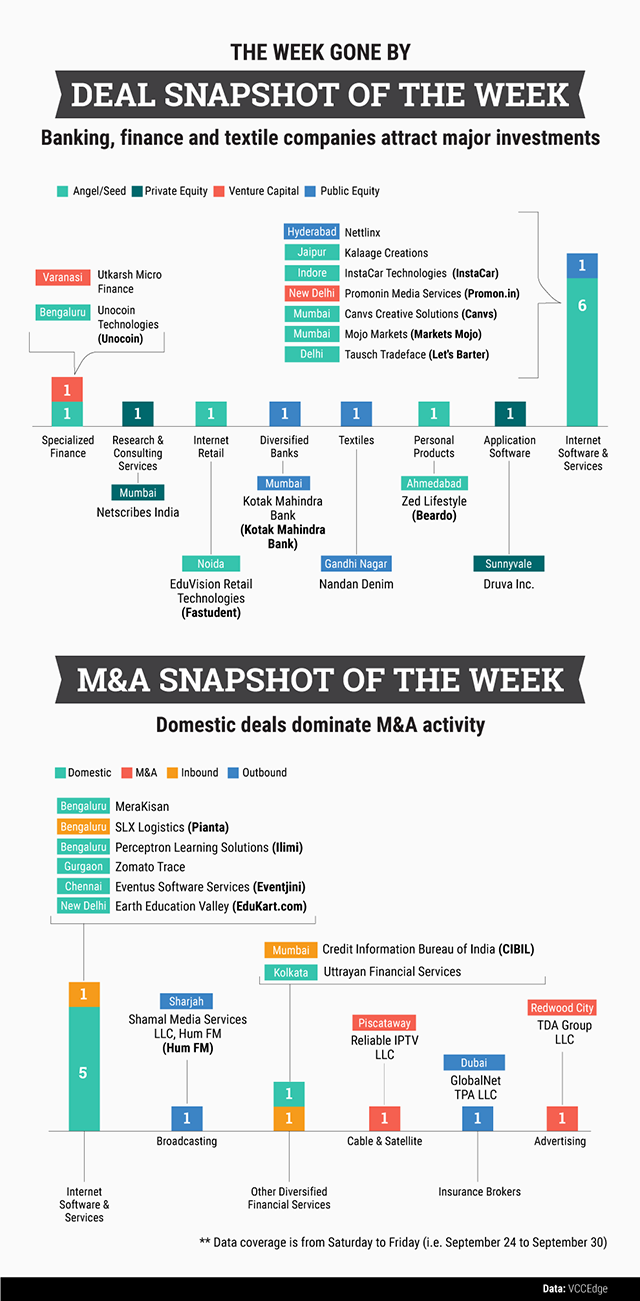

The week saw Dutch financial services major ING dilute a part of its stake in Kotak Mahindra Bank via an open-market transaction. Almost a fourth of the shares offloaded by ING were bought by the Canadian Pension Plan Promotion Board (CPPIB) for $189.75 million.

Microlender Utkarsh Microfinance Ltd raised a little short of $60 million from domestic financial institutions and private equity funds, including HDFC Standard Life Insurance, HDFC Ergo General Insurance, ICICI Prudential Life Insurance, Shriram Life Insurance, RBL Bank, Small Industries Development Bank of India, Faering Capital and Arpwood Capital, so as to lower the foreign holding in the company to below 49%. Utkarsh was one of 10 non-banking financial companies (NBFCs) that had won the licence to start a small finance bank. The equity dilution is in line with Reserve Bank of India’s guidelines that mandate such licence holders to have foreign equity below 49%.

In yet another deal, enterprise IT solutions provider Druva Inc pocketed $51 million in Series E funding from Nexus Venture Partners, Sequoia Capital India and others.

Although nine of the 15 deals this week were inked by technology firms, in terms of deal volumes, banking and financial institutions and a textile company won the show.

In the M&A space, IT company NIIT Technologies acquired Bengaluru’s ed-tech company Perceptron Technologies which runs Ilimi, a white-label service. A white label service is one that is produced by one company but marketed by another.

Another major acquisition was that of ed-tech startup Edukart by payment services provider Paytm. Edukart, which is backed by cricketer Yuvraj Singh, and Paytm founder Vijay Shekhar Sharma, was bought by the latter’s One97 Communications Ltd for an undisclosed amount, after it was reportedly unable to raise fresh funding.

Like this report? Sign up for our daily newsletter to get our top reports.