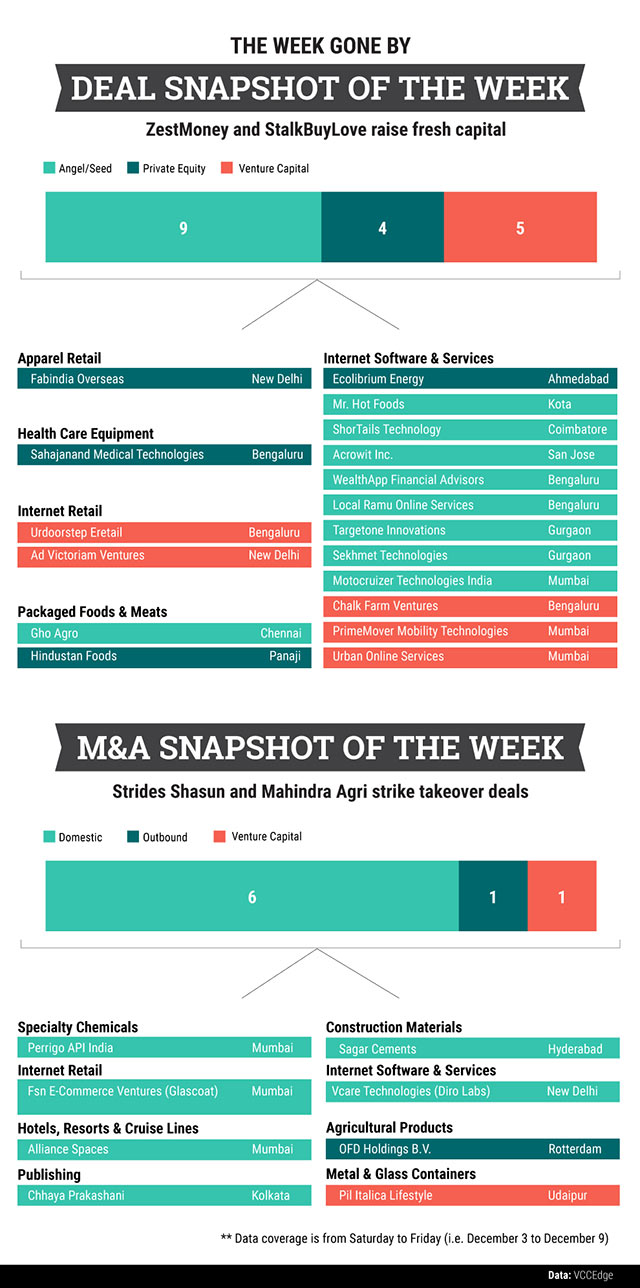

In the deals space, venture fund Sixth Sense Ventures invested $1.1 million for a 16% stake in BSE-listed Hindustan Foods Ltd through a preferential allotment of shares. Ethnic wear firm Fabindia got another investor on board with Nandan Nilekani’s family office Entrust investing an undisclosed amount for 2% stake.

In the M&A space, pharmaceutical company Strides Shasun acquired drugmaker Perrigo API India Pvt. Ltd for $14.83 million.

Mahindra Agri Solutions, a subsidiary of Mahindra & Mahindra, agreed to acquire up to 60% stake in Netherlands-based fruit distribution company OFD Holding BV for $5.33 million.

Advertisement

Like this report? Sign up for our daily newsletter to get our top reports.

Advertisement