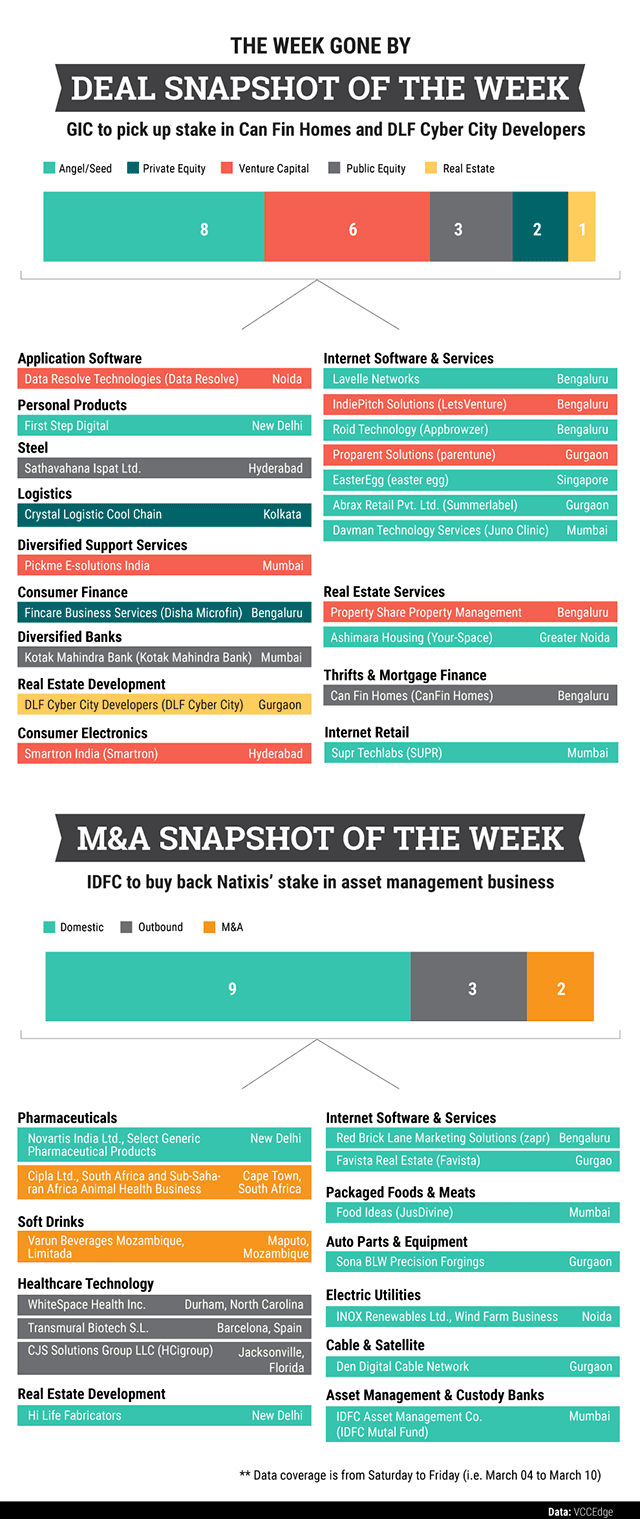

Real estate developer DLF Ltd’s promoters are set to sell their 40% stake in their commercial rental property arm, DLF Cyber City Developers, to Singapore sovereign wealth fund GIC in a deal estimated to be around $1.8 billion.

In the public equity markets, Canadian pension funds CDPQ and CPPIB picked up a 1.5% stake in Kotak Mahindra Bank for $338.8 million and GIC bought a 13.45% stake in Can Fin Homes from Bengaluru-based Canara Bank for $113 million.

In another deal, Bengaluru-based Fincare Business Services, which runs small bank licensee Disha Micro Finance, got new investors on board in a primary and secondary deal valued at $75 million.

In M&A deals, IDFC Financial Holding Company is set to buy back the 25% stake held by Paris-based Natixis Global Asset Management in IDFC Asset Management Company for close to $37 million.

Among other deals, Sona Group bought out its joint venture partner Mitsubishi Materials in Sona BLW Percision Forgings for an undisclosed amount and IT company Tech Mahindra agreed to acquire US-based healthcare technology firm CJS Solutions Group.

Like this report? Sign up for our daily newsletter to get our top reports.