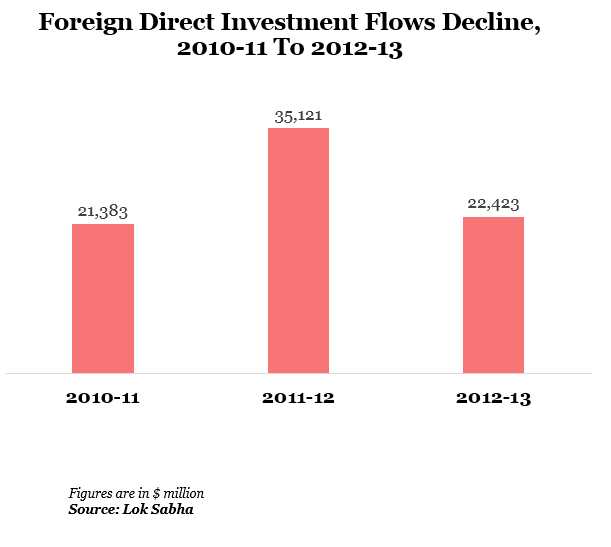

Despite the hardsell (admittedly somewhat delayed), India’s foreign direct investment (FDI), or long-term investment commitments by foreign investors, declined 36% from $35.1 billion in 2011-12 to to $22.4 billion in 2012-13.

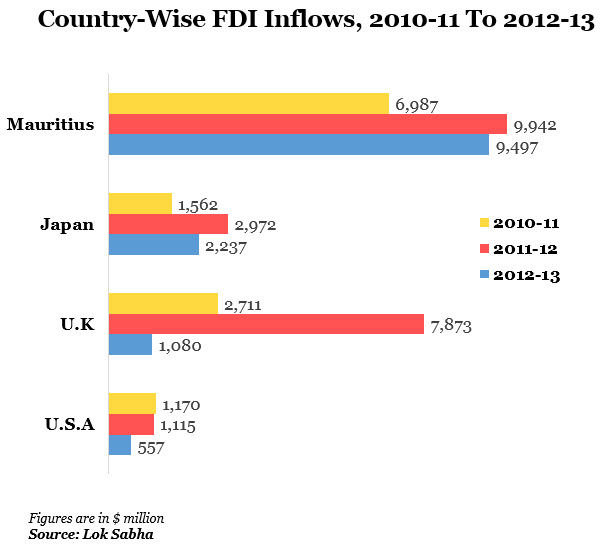

More interestingly, FDI from America has dropped from $1.1 billion in 2011-12 to only $557 million in 2012-13. And inflows from the U.K have declined from $7.9 billion to $1.1 billion. Mauritius, which has a double taxation avoidance treaty (DTAA) with India and offers easy business rules, continues to be the preferred route for foreign investors… inflows continued to be over $9 billion in 2012-13.

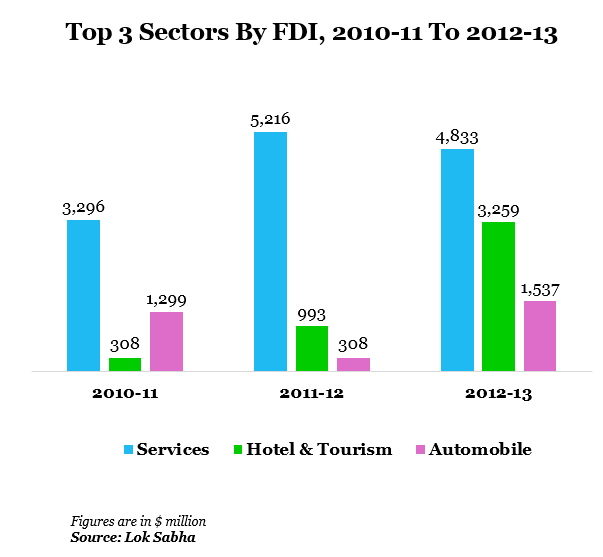

And not surprisingly, services (including financial, banking, insurance and other businesses) top the inflows chart with a fund flow of $4.8 billion. This, however, was a decline from $5.2 billion the sector attracted in 2011-12. The automobile industry attracted funds to the tune of $1.5 billion – an increase of 62% from $923 million in the previous year.

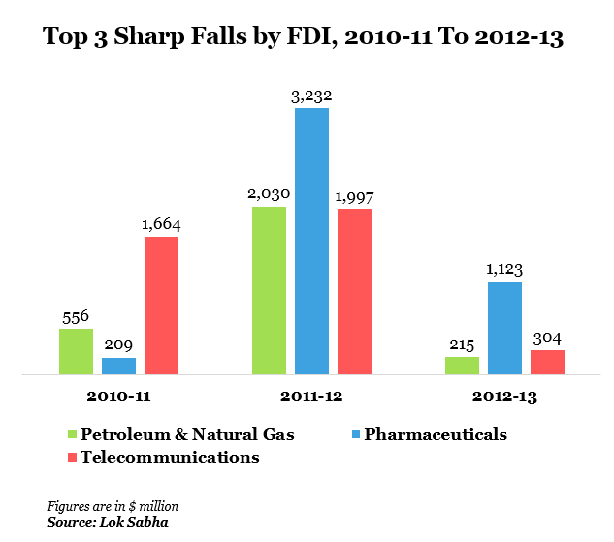

And the sectors that saw the sharpest decline in inflows include petroleum and natural gas, pharmaceuticals and telecommunications.

Chennai has seen a spurt in investments with overseas investors bringing in $2.8 billion in 2012-13. Delhi, on the other hand, has seen foreign investments decline to $3.2 billion from nearly $8 billion in 2011-12. Mumbai, Hyderabad and Bangalore are the other preferred destinations of foreign investors.

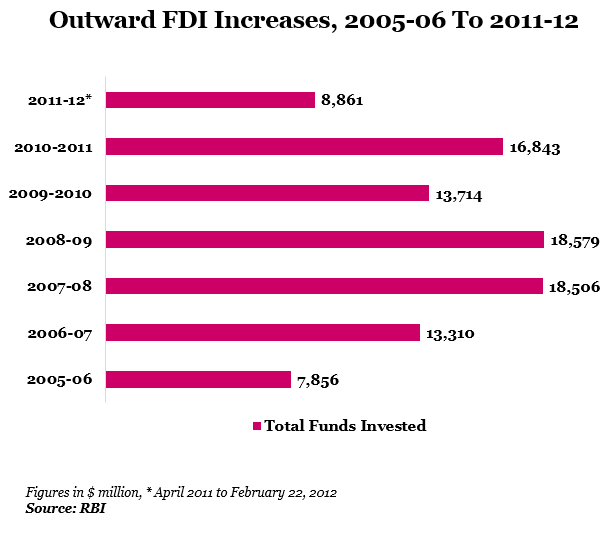

Here’s a comparison: outward investments by Indian companies (FDI from India) increased during 2005-06 to 2010-11. From $7.8 billion, it moved up to over $18 billion in 2008-2009. It, however, has dropped sharply to $8.9 billion in 2011-12 (till February 22, 2012).

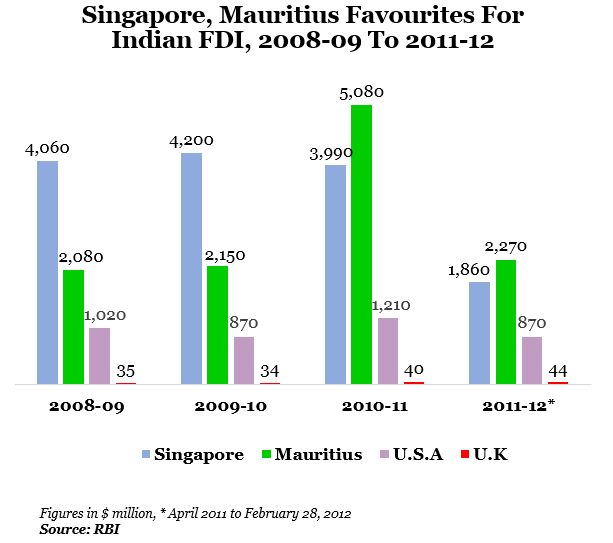

And Indian companies have been investing across the world… Singapore and Mauritius continue to be favourite destinations. But investments in America declined from $1.21 billion in 2010-11 to $870 million in 2011-12 (till February 28, 2012).

The Government, in a flurry of announcements recently, has also announced major reforms in foreign investments including 51% FDI in multi-brand retail, hiking FDI in single brand to 100% from 51% and allowing foreign airlines to pick up 49% stake in domestic airlines. It would be interesting to see whether these steps would move the needle in the coming year.

This post 'US FDI into India, Just $557M last year' originally appeared on indiaspend.org.