Premium

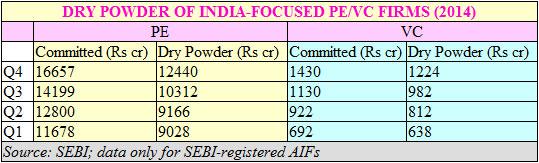

The quantum of money committed by investors in India focused private equity and venture capital funds registered with securities market regulator SEBI under the new alternative investment funds (AIF) norms but not yet deployed, rose by a fifth to around $2.2 billion at the end of last quarter.In particular, undeployed ......

This is a Premium article. Please subscribe or log in to read the full story!

Here's a selection of our recent premium content.

Already a member? Click here to log in.