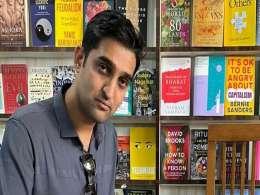

Girish Mathrubootham, chief executive of cloud-based customer engagement platform Freshworks Inc, says the recent rebranding exercise that saw the company’s name change from Freshdesk Inc was just the first step in establishing itself as a multi-product brand. In an interaction with VCCircle, Mathrubootham also talks about turning down acquisition offers, expansion plans and product launches. Excerpts:

Last year, you had stepped on the gas to scale up. Will 2017 be the year of consolidation?

In 2017, we have come to be known as Freshworks. This will also be the year when we will unleash our multi-product vision. We had booked 40 domains in 2011 and that could be an indicator (of what we propose to do). But as a venture capital-funded company, it is important to first establish the brand in a particular area before branching out. To sum it up, 2017 will see our transformation from a one-product company to a truly multi-product brand.

As far as consolidation is concerned, even Formula One drivers have to apply the brakes once in a while. We will definitely be racing ahead as a growing company, but we may also slow down as and when necessary.

A multi-product strategy will definitely give diversity to your product portfolio. But, when does one decide that it is time to stop and start consolidating?

To say that we will continue to grow by adding a couple of new products every year does not make sense. We need to build a portfolio that makes sense to the customer while ensuring we have a broad range of products. We need enough TAM (total addressable market) to be able to grow to where we need to grow. Once you have enough bandwidth to grow multiple products, it would be the time to stop expanding the portfolio.

Acquisitions have played a key role in your high-growth game so far. How will it evolve going forward?

We are not looking at any specific area, but broadly we will keep an eye on allied areas, including CRM (customer resource management) and customer support. We do not have any plans to scout and search for specific companies, but we will continue to acquire as and when we find the right match.

What do you have to say about inorganic growth, now that several companies are preferring that route?

It certainly has to be done very carefully. We have always ensured that the size of our acquisitions is small so that integration is easier. We make sure the founders are passionate and are working on the same dream, and are ready to contribute as part of the larger team. It is definitely a challenge to pull it off because we have to deal with existing employees, probably also a different work culture. However, we have been fairly lucky so far.

Media reports have indicated that you may consider putting Freshworks on the block even before you take the IPO route, if the numbers match your expectations.

This is not a decision that can be taken unilaterally at my end. There is a board of directors and shareholders and, any decision on that front will be a collective decision, if things do come down to that. However, as a personal preference, I would like to continue to run this business. In fact, we have already turned down three offers, the latest being as recent as last week. So, that seems to be the broad stand.

Having said that, this being a VC-funded business, if there is an attractive offer on the table, I will have to take it to the board. Finally, the board will have to take a call.

Some of your key top-level management positions are currently vacant. You do not have a COO after Nishant Rao’s exit. We also understand that Freshworks is yet to appoint a CFO.

It is about finding the right person. We are talking to a few potential individuals and may announce a new COO in a couple of months. For the global CFO’s position, we will be initiating a hunt from our US base.

Are you considering expansion in, say, a relatively underdeveloped but potential market like Africa?

We cannot afford to be in every country; at least not yet. But we may consider setting up additional bases if we feel that a certain region, by way of more business for us, merits one. Berlin has given us a nice footprint in Europe, which is a big market. In Africa, we have reseller partners and use their presence to leverage our business operations. Currently, we are not in active engagement with any new markets.

For you, what are parameters to set up a new base?

For every IT-related product, the US and the UK are a no-brainer as they are big markets. Our expansion into Australia, for example, started as a trial based on the proactive efforts of one of our early employees, who felt it was a potential market. The Berlin expansion was purely opportunistic and done because we had an excellent leader who was willing to join us.

Your India presence, in terms a physical set-up, is currently limited to Chennai. Was it a conscious choice? If so, did you ever feel that it may have dampened your growth a bit?

Many a potential employee looking to join Freshdesk was not comfortable with the idea of moving to Chennai. During the initial days, it was a big problem. But now, we find an increasing number of people open to working here.

I am not saying that we refuse to expand beyond Chennai. We may consider setting up an additional physical presence, but that will be a decision taken more from a PCP (person continuity planning) and business continuity planning approach, based on how things evolve. We constantly debate about shifting to Bangalore, but eventually put the idea on the back burner.

Which are your existing top markets? Where does India rank currently?

India continues to remain our sixth-largest market. After the US and the UK, Europe is definitely the biggest market. While I do not have the exact details, country-wise, I can definitely say that Germany, Poland, the Netherlands, Australia and Canada are some of our top-performing markets. While the US accounts for about 40% of our total customer base, the UK and Europe together account for another 40%.

What do you think is the differentiator that has worked for Freshwork, compared to, say, a Salesforce or Zendesk?

Any truly good product shines on its own merit. In Freshwork’s case, we ensure the products we develop adhere to the value triangle – full-featured products, good user interface design and affordable pricing. This offers good value to a customer. In any given market, a product that has the mix of all these attributes does well. And this has been our forte.

At the core, you have always been an SME-focused company. When do you see yourself moving aggressively towards the mid- to upmarket segments?

We already have big customers and are only seeing an increase in their share. Customers in this category come inbound, start using our product with one of their teams and then eventually expand. In 2015, they accounted for about 15% of our total customer base. Today, they are at about 30%.

What about revenue growth and profitability? What percentage of your users are paying customers and what is the average revenue per user (ARPU)?

We do not disclose these numbers. All I can say is that we have been registering 70% year-on-year growth over the last two years. As for ARPU, I can only say that Freshdesk generates three times more ARPU than most of our other products.

You have always been the public face of Freshworks while Shan Krishnasamy, your co-founder, has been quite reticent…

He is an introvert by nature, and likes talking more to the machines. He is someone who does not like to talk much and does not feel at home at events. But he has his own set of friends with whom he is at ease. In fact, as we speak, one of your peers from the journalistic fraternity is doing a story on him. Hopefully, we will get to see more of him.

Like this interview? Sign up for our daily newsletter to get our top reports.