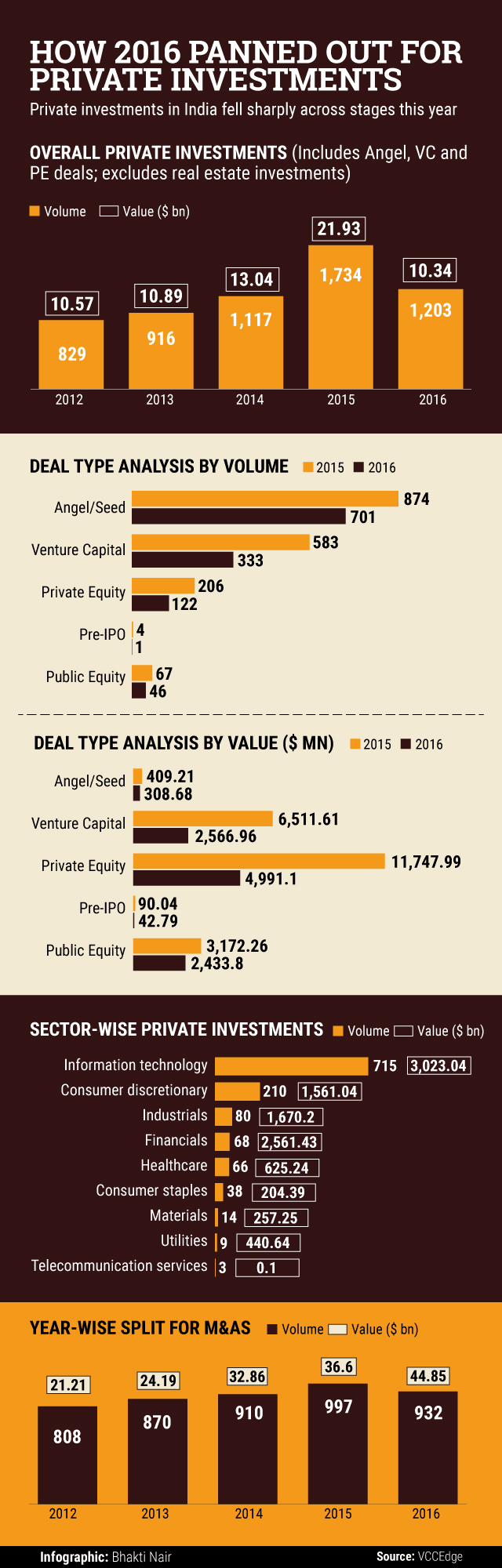

Private equity and venture capital investments in India halved this year after hitting a peak in 2015 as investors tightened their purse strings, show provisional data from VCCEdge, the research platform of News Corp VCCircle.

Data collated through mid-December show that both the volume and value of PE and VC deals declined sharply, reflecting the slowdown in private investments was not just due to a few companies getting less money.

The total value of private investments last year had got puffed up by few large funding rounds related to firms such as cab aggregator Ola. However, the decline in the deal volume this year shows the slowdown is much more broad-based.

On the flip side, despite poor sentiment more than 1,000 startups got funded, as we had predicted in April.

This is less than the over 1,300 firms that got money in 2015. But the relative resilience of angel and seed-stage investors helped startups get their first cheques this year. Angel investors, too, were affected by weak investor sentiment but much less than the VCs.

The more mature private equity investments continued to slide, too.

M&A dealmaking was largely flat in terms of volume but a few large deals such as that of Reliance Communications-Aircel and HDFC Standard Life-Max Life puffed up the value of transactions related to Indian companies.

To be sure, dealmaking has continued in the past week—Claris Lifesciences agreed to sell its injectables unit to Baxter International for $625 million—and with around 10 more days to go this year, the final statistics would change. Keep track of VCCircle’s year-end stories for more insight into how dealmaking unfolded in 2016.

Like this report? Sign up for our daily newsletter to get our top reports.