Naina Singh no longer buys her skincare products from the upscale showrooms of Greater Kailash in Delhi. This home-maker now prefers to pick them up from a small store sporting the red banner of Patanjali Ayurved, from which the picture of patron and de facto owner Baba Ramdev smiles down benignly.

It was her tryst with Patanjali Kesh Kanti Natural shampoo that made her a convert last summer. “I now buy almost everything that Patanjali makes, from atta to ghee to the creams as well as pulses and the spices,†says Singh.

Patanjali Ayurved Ltd today is not just about amla juice and chyawanprash. It sells around 500 consumer goods, from ayurveda-based products to staples such as clarified butter (ghee), pulses and edible oils to personal products such as toothpaste, hair care and skin cleansers and processed food products such as noodles, biscuits and juices.

Acharya Balkrishna, managing director, Patanjali Ayurved, and Baba Ramdev's most loyal disciple, gives credit to the yoga guru for all this. “The vision has been very simple. Whether medicines or food products, people of this country should have the best at the lowest possible price,†he says. He claims the company will hit the Rs 5000 crore turnover mark in FY16 – almost at par with the domestic revenue of consumer goods makers Dabur India, Marico or Godrej Consumer Products.

In FY15, the company registered a turnover of Rs 2000 crore. The firm now expects to enter the billion dollar league in terms of revenues in the coming financial year. Its estimated profit for the twelve months ending March 31, 2016, benchmarked against large industry peers should already make it a $2-3 billion company by market value, purely by price to earnings ratio, as per VCCircle estimates.

To be sure, even as it gives a scare to the biggies of India's FMCG industry strong competition, it is doubtful whether Patanjali, which swears by its ayurveda-inspired products, will be able to maintain the scorching pace it has set.

As it gears up to become possibly the biggest homegrown seller of consumer goods it will face new challenges.

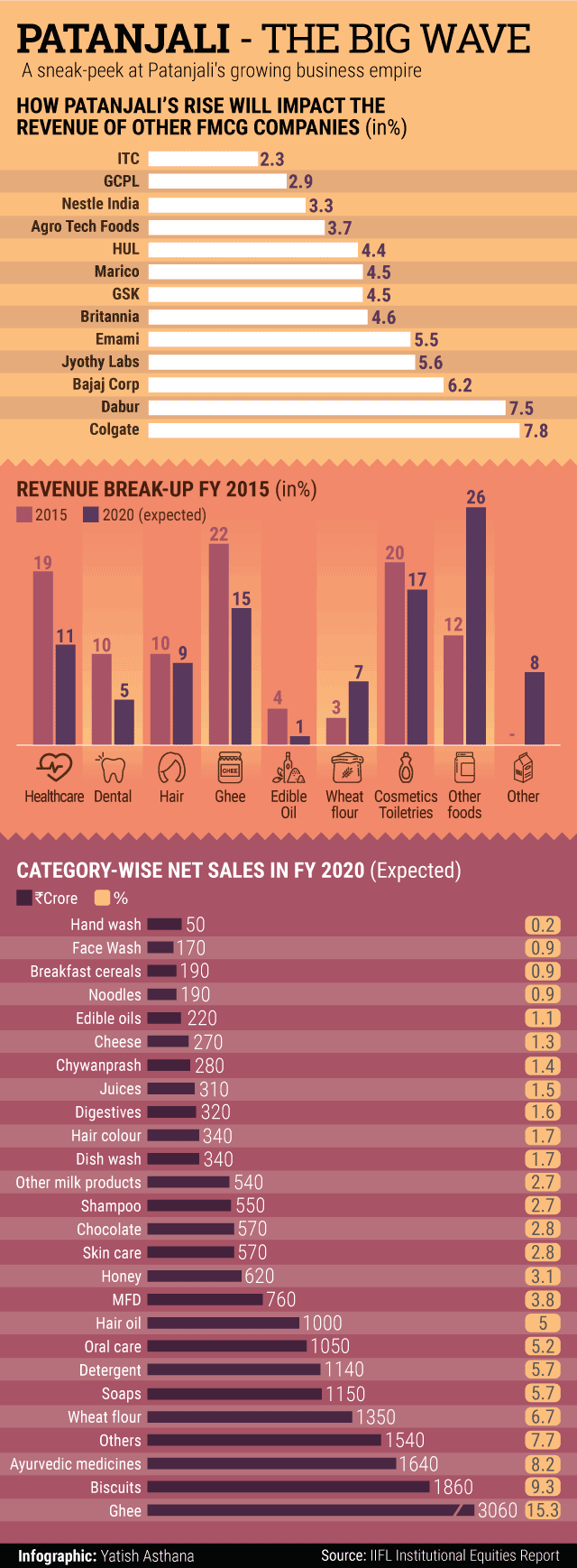

Indeed, Patanjali's projected growth defies the slowdown in the FMCG industry at large. To be sure, it has grown almost five times between FY12 and FY15 when top FMCG firms in India such as Hindustan Unilever, Godrej Consumer, Marico, Dabur and Emami grew 30-70 per cent in the same period. Nestle's sales have actually declined in the same period.

This may look ambitious but add the slew of product launches this fiscal, and key distribution pacts in place, and it may not be too far from its target at the end of next month.

Overflowing aisles

Patanjali's top selling product is ghee, accounting for 30-35 per cent of the company's revenue, according to a report by HSBC Research. Then comes toothpaste Dant Kanti (8 per cent), hair cleansers (5 per cent), wheat flour (5 per cent), and honey (4-5 per cent), says the report. Health care products, its mainstay for many years and on which it has built the Patanjali platform, accounts for 20 per cent of the revenue.

“Pricing itself cheaper than the market leader in each product area is the reason for its popularity,†says Devangshu Dutta, chief executive, Third Eyesight, a retail and consumer management consultancy.

As per the HSBC report, Patanjali had 20 per cent share in the Rs 1240 crore ayurveda-based toothpaste market in FY15, while Dabur had 65 per cent share. By FY20 Patanjali's Dant Kanti toothpaste will have 50 per cent share, while Dabur's market share will drop to 40 per cent in the ayurveda toothpaste category, it says.

Dabur, which has Babool, one of the oldest ayurveda-based toothpaste brands in the country, however, scoffs at the idea. “While a lot of companies today offer herbal or ayurvedic products, Dabur enjoys the consumer’s trust because of its ayurvedic heritage,†says Lalit Malik, chief financial officer, Dabur India. The company says it is close to introducing a range of products in the value-added and premium category, which will help improve its market share.

A report by IIFL Institutional Equities projects Patanjali's annual turnover at Rs 20,000 crore by FY20. The report says it can expect to have a big share of the market in categories including honey, ayurveda-based medicines and ghee. In fact, by FY20, eight categories are expected to have a turnover of Rs 1000 crore each.

Balkrishna, however, says Patanjali has a much loftier goal than toppling any rival brand. “Unlike other companies, which have commercial interest at the heart of everything, our aim is to make products for the welfare of people,†he says.

For the people

That purportedly is the reason why Patanjali is launching an orange juice brand in the next one to two months, which it claims will be “real†orange juice.

“One of the reasons why companies do not sell real orange juice is because it is tangier in taste and not thick in density,†says Balkrishna.

Dabur sells its juices under the 'Real Active' brand.

Patanjali also plans to enter the baby care segment with cream, lotion, soap and shampoo apart from introducing Power Vita, a malt-based health drink brand. All this, the company plans to roll out in the market by early next month.

The aim is to enter categories where consumers are unhappy with quality or price, says Balkrishna. “The decision to enter a new category is triggered by a controversy or when Baba Ramdev is approached by people,†he says, alluding to the launch of its instant noodles brand.

That, however, hasn't stopped it from downplaying the fact that Patanjali Atta Noodles is actually a 50:50 blend of atta (wheat flour) and maida (refined flour made from wheat flour).

Patanjali launched its Atta Noodles last November, almost at the same time when Nestle India Ltd's Maggi returned to stores, five months after the multinational's noodles brand was pulled out over safety concerns.

Nestle, its biggest competitor in the instant noodle category, remains unperturbed. “Every brand seeks to define its competitiveness given its intrinsic strengths, its appeal and the price-value relationship it seeks to define,†says the Nestle India spokesperson.

Dabur and Nestle aren't the only two companies watching Patanjali's every move. Hindustan Unilever Ltd (HUL), India's largest FMCG company, is also building its arsenal. It recently revived its herbal brand Ayush, introducing a range of new products across haircare, skin care and pain balms. The acquisition of Kerala-based hair oil brand Indulekha Bringha hair oil late last year also needs to be seen in the same light.

Speed test

Market analysts say the back-to-back product launches by Patanjali is an area of concern. A major food products company such as ITC Ltd or HUL takes one to one-and-a-half year to launch a new product. Even then, the product is first launched in select markets. Another three-four months later, depending on the consumer feedback, it is gradually rolled out across the country. Similarly, skin care products need to go through a battery of tests before these can be launched.

“Launching a regular cream may take only six months to one year, but for an anti-wrinkle cream, or age-specific cream, it is a much longer journey,†says Rajat Wahi, partner and head, consumer markets, KPMG in India, an audit firm.

But this doesn't bother Balkrishna, who says the firm maintains high standards of quality. Last month there was much discussion on social media on the quality of its ghee, he says. “But the Food Safety and Standards Authority of India (FSSAI) cleared our product.â€

Rather, according to him, inability to meet the spiraling demand for its products is the biggest concern. Atta, juices, rice, and other food products are processed at its Haridwar plant, Patanjali Food and Herbal Park. This factory also makes skin and hair care products. Its other factory in West Bengal rolls out 400-500 tonnes of biscuits every day.

Hence, expansion is the next big task. Patanjali plans to spend close to Rs 1000 crore in FY17 to ramp up its manufacturing capacity. The money will come as loans from public sector banks. It is looking at starting three new plants. “We are looking at different states including Andhra Pradesh, Maharashtra, West Bengal and Madhya Pradesh. We plan to acquire 400-500 acres of land in each state, to build state-of-the-art facilities,†says Balkrishna.

(This is the first part article in a three-part series on Patanjali Ayurved. To read the second part on how Patanjali created a network of stores, click here. To read the third part on Patanjali's pricing and marketing strategy, click here.)