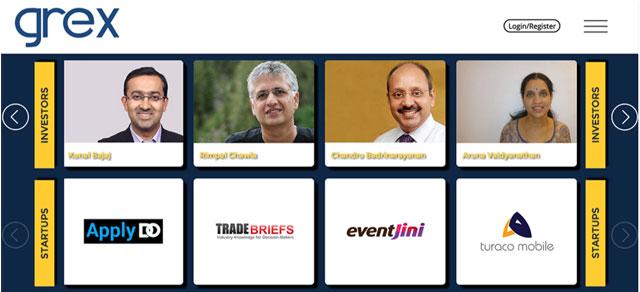

GREX Alternative Investments Market Pvt Ltd, an integrated exchange-like platform that allows startups and unlisted companies raised capital from private investors, has secured Rs 4 crore ($625,000) in its first round of fundraising from angel investor Kunal Bajaj, MSCI's Chandru Badrinarayanan and a group of unnamed private investors.

The funds will be utilised by GREX to strengthen its IT backbone and for bringing in new financial products/ features on the information sharing platform, the company said in a statement.

“Our intention is to ensure we build a participative ecosystem and bring down the cost of capital for the companies," said Manish Kumar, founder and CEO of GREX.

"Many of the companies are losing out almost 40-50 percent of their equity base in the very first or second rounds of capital raise. This is expensive and prohibitive. On the other hand there is huge affluent class of private investors who simply do not have an access medium to these companies. We are simply integrating the mutual needs in a rule and process based framework that caters to all and it is built on a solid IT backbone,†Kumar added.

GREX also counts Rimpal Chawla, Aruna Vaidyanathan, Rajeshwari Bhattacharyya and Reenu Singh as investors on its website.

GREX is being positioned as a stock exchange styled platform for startups to raise capital. The company claims that more than 200 startups and over 150 investors are in the process of registering on its platform. About eight companies have completed the full data disclosure process that GREX says is mandatory. The platform is expected to go live next month when the first startup will raise money, the company said.

GREX was founded in 2012 by Kumar along with Abhijeet Bhandari, Sanjay Nishank and Surojit Nandy. The objective is to build an alternative funding ecosystem for startups, along with more exit options for investors who back risky ventures.

Companies seeking to raise funds through GREX need to dematerialise their shareholding. GREX has tied up with depository services and transfer agents to facilitate the process.

Once a company is registered on the platform (replete with docketed information about the company, its financials and fundraising objectives) investors can follow the company for some time and decide if they wish to put money.

"The need for GREX is obvious - entrepreneurs and investors need a more transparent and efficient way to partner with each other,†said Kunal Bajaj, an investor in GREX.

In his previous avatar, Bajaj was the India director at Analysys Mason, a strategy consulting and advisory services firm. He also has investment positions in Healthifyme, Qlicket and other startups.

Badrinarayanan is the head of India sales at MSCI since June 2013. He is responsible for new business development for MSCI's index, portfolio risk and performance analytics products and services.

GREX is looking to provide an alternate platform as against the proposed special platform for startups to go public and raise capital as proposed by capital markets regulator SEBI. The final guidelines on this special platform is expected to be out soon.

There are already other crowdfunding styled angel investor platforms that help startups raise capital.