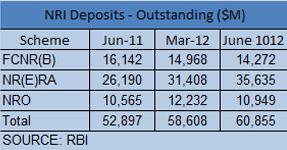

The dollar inflow from Non-Resident Indians (NRIs) to their home country surged during the April-June quarter in 2012. The Non-Resident External (NRE) rupee account also witnessed a constant inflow of dollar deposits which pushed up the NRI deposit outstanding by a little over 13 per cent quarter-on-quarter as of June 30, 2012. On a year-on-year basis, the outstanding NRI deposits grew by a third.

According to data from the Reserve Bank of India, the banks saw an inflow of almost 50 per cent increase to $7.4 billion in the quarter ended June 2012, compared to the previous quarter. South-based banks, such as Federal Bank, Indian Overseas Bank and South Indian Bank, continue to receive close to 20 per cent of their deposits from the repatriates, especially those from the Gulf.

As of March 31, 2012, Federal Bank’s total NRE deposits constituted 16.27 per cent of the total deposits and reached a figure of Rs 7,963 crore, compared to Rs 5,871 crore in FY11 – thus registering a growth of 35.64 per cent.

“We were the first bank to respond to deregulation of interest rates on NRE fixed deposits and our NRE fixed deposit portfolio grew 91 per cent during FY12,” said a senior banker with Federal Bank.

The interest rate on NRE deposits was deregulated in December last year, which led to high inflow of money into the NRE account during the last fiscal – taking the inflow to the highest ever level in 10 years. Following the deregulation, all banks raised their interest rates on such deposits from around 3 per cent to 10 per cent and private equity firm ChrysCapital-backed Federal Bank was among the first ones to increase the interest rate.

According to Brinda Jagirdar, SBI’s chief economist, “Due to the crisis in eurozone, NRIs are looking for safe, liquid and repatriable options to park their money in Indian banks that offer returns on par with the domestic term deposit rates.”

She also added that investors find it very attractive, compared to the interest return of 1-1.5 per cent they receive overseas. The remittance is expected to surge in the coming months as well, she said.

Although the weaker Indian currency means repatriation takes some of the sheen off the returns, it still remains higher than the comparable securities overseas. Besides, if the money is used within India, it does not face currency depreciation effect. Rather, the same amount of dollar inflow yields higher returns in Indian currency.

(Edited by Sanghamitra Mandal)