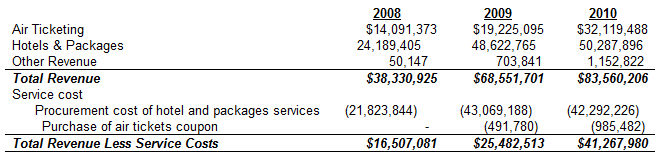

MakeMyTrip Segment Revenues (In $ million)

The company has cut its losses from $18.89 million FY08 to $7.35 million in FY09 to $6.2 million in FY10.

Number of transactions (In ‘000s)

2008 2009 2010

Air ticketing 1,029.1 1,250.8 1,766.9

Hotels and packages 36.9 81.3 109.7

MakeMyTrip has shown an improvement in net revenue margins in air ticketing from 7.1% in 2008 to 7.6% in 2010. Net revenue margins for hotels and packages improved from 8.9% to 14% in the same period.

Use of IPO Proceeds - MakeMyTrip intends to use the net proceeds received from this offering to expand our operations by acquiring or investing in strategic businesses or assets that complement its service and product offerings. It also plans to invest in enhancements to technology, as well as for working capital and other general corporate purposes.

Shareholders

SAIF Partners is the largest share with a 51.32% stake.

Deep Kalra, Co-founder & CEO - 14.45%

Tiger Global Private Investment Partners - 12.14%

Helion Ventures - 11.97%

Sierra Ventures - 7.98%

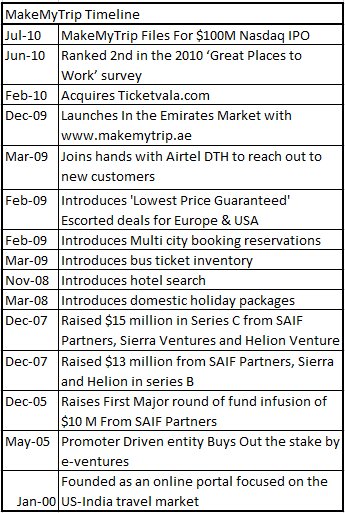

MakeMytrip Timeline