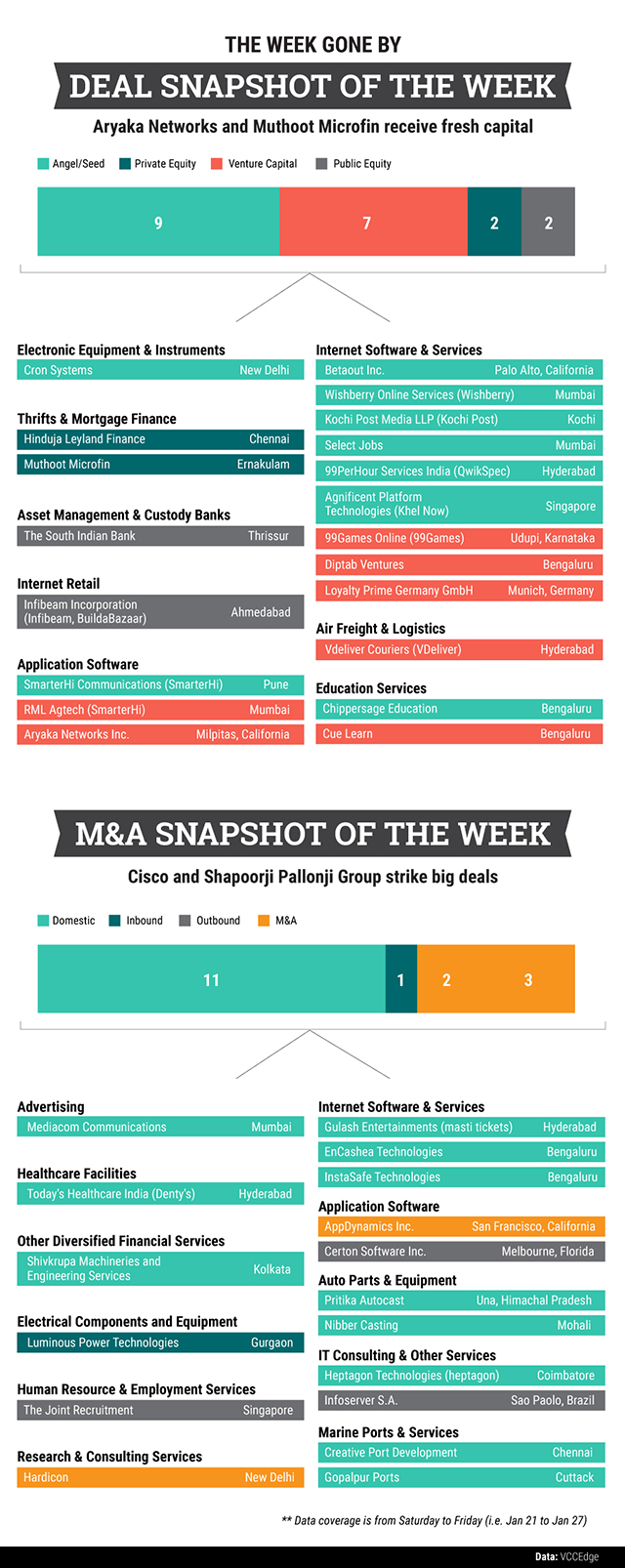

Private equity firms Creation Investments Capital Management and ChrysCapital struck investment deals while Tata Steel Ltd and Wipro Ltd sealed acquisition deals in the week gone by.

US-based Creation Investments picked up an 11% stake in Muthoot Pappachan Group’s microfinance arm, Muthoot Microfin, for $19.6 million while ChrysCapital raised its stake in The South Indian Bank to 4.93% for $9.5 million. Brand Equity, the ad-for-equity arm of Bennett, Coleman and Company Ltd, agreed to invest in e-commerce firm Infibeam Incorporation.

In funding deals, US-based Aryaka Networks raised $45 million in a Series D round led by Third Point Ventures while Bengaluru-based ed-tech company Cuelearn received $15 million from CapitalG and Sequoia India.

The week also saw networking giant Cisco agreeing to pay $3.7 billion for software company AppDynamics. France’s Schneider Electric completed its acquisition of Luminous Electronics after getting approval from the Competition Commission of India to acquire the 26% stake it didn’t already own for $139.25 million.

The week also saw Wipro agreeing to acquire Sao Paolo-based Infoserver SA for $8.71 million and Hyderabad’s Cyient sealing a deal to buy Florida-based Certon Software for $7.5 million.

In the ports sector, Shapoorji Pallonji Group announced a deal to acquire a 51% stake in Gopalpur Ports for $102.61 million while Tata Steel said it would acquire a 51% stake in Creative Port Development Pvt Ltd.

Like this report? Sign up for our daily newsletter to get our top reports.