India’s IT firms have increasing profits, yet declining valuations. While this seems counter intuitive, it shows that company size and the specific business they are in matters.

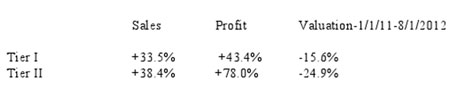

An August 6, 2012 Times of India article reported that tier II IT companies are out performing tier I in sales growth and profit margins. The ETIG analysis was of 17 tier-II IT firms 38.4 per cent in revenue growth and a 78 per cent in net profit at the aggregate level from a year ago based on the latest quarter’s results. Yet, the top four IT companies - TCS, Infosys, Wipro and HCL Technologies had smaller sales and profit increases - sales rose 33.5 per cent, while profit grew 43.4 per cent.

At the same time, the MW ITIndex India Edition, shows the value of tier II companies are declining faster than tier I. Between January 1, 2011 and June 30,2012, tier 1 company valuations CAGR dropped to -15.6% while CAGR for tier II companies dropped to - 24.9%.

The Index includes a total of 36 Indian IT companies in both tier I and tier II. The shows that starting in January, 2011 and continuing into 2012, pressure on the valuations intensified.

Tier I companies have less profit margins and sales increases than tier II; yet tier II valuations are dropping faster than tier I companies. The question is why?

The comparison reveals the following:

The reality is that these valuation declines mean different things for each type of company, but the one impact in common is that they have reached the end of relatively easy paths to growth.

And growth matters because a company’s value is based on the future, not the present. If a company is in a declining market, it is worth less than a smaller company in a fast growth market. It is obviously why we are seeing high multiples being paid for SaaS companies right now.

So, for tier 1 companies going forward it will not be enough for them to continue making acquisitions that simply move them up the value chain in general terms or establish a presence in new geographic markets. Instead, they will need to focus on the following: very large acquisitions that significantly add to their skill sets, establish deeper domain experience, and develop or acquire IP of significant value.

India’s tier II IT companies face the increasingly difficult challenge of how to grow fast enough to stay relevant. Even though they have encountered good P&L performance recently, with India’s GDP growth slowing, and industry contracting, it is not translating to increased enterprise value.

They will have to turn to acquisitions or combining with others to achieve a size and breadth that makes them competitive.

A good acquisition of this type was iGATE’s purchase of Patni Computer Systems for $US921 million in early 2011. This is a synergistic combination: Patni was a high growthcompany while iGATE was bigger yet slower moving.

Together, they broke the US billion dollar revenue mark, giving the new company clout in a market where size matters.

India IT companies are at a turning point where size of the entity, and what the company does will matter.

(Gaurav Sharma is the Senior Vice-President and Managing Director of the India Practice Group of martinwolf M&A Advisors.)