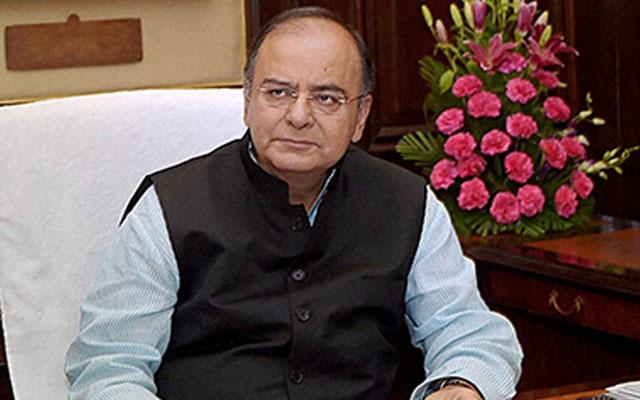

As a measure to provide more strength to the banking system, Finance Minister Arun Jaitley announced a plan to revamp the ailing public sector banks (PSBs) on Thursday. The announcement comes just days after the government had announced a Rs 70,000-crore package to revive PSBs with a Rs 25,000 crore allocation in the current fiscal.

The plan called ‘Indradhanush’ will consist of seven elements to introduce new frameworks of accountability and governance reforms while also laying stress on empowerment, appointments and bank boards. The plan will also work on the capitalisation needs of banks and de-stressing. The government has not announced the full details of the plan yet.

"Each bank will be monitored based on key performance indicators" the finance minister said.

Minister of State for Finance Jayant Sinha in a conference of Indian Private Equity & Venture Capital Association (IVCA) last month had said the government was preparing a roadmap to revitalise the banking system in India, the details of which will be announced shortly.

At the conference, it was also announced a plan to set up a bank board bureau to replace the existing appointments board which will be operational from April.

With Indradhanush, the government aims to increase credit flow in the system while also ensuring that it does not fall in the stressed asset trap again. Banks have been unwilling to cut rates despite the RBI providing for three rate cuts.

Arun Jaitley assured that there was no need for panic as far as health of PSBs is concerned while also laying stress on the fact that initiatives taken by the government have already helped fix some problems.

With the monsoon session washed by protests and none of the key legislation passed, the government will look forward to announcing more and reform measures to keep investor interest buoyed.