The long-term returns of Singapore sovereign wealth fund GIC have dropped within a whisker of a record low struck during the financial crisis, and its chief executive cautioned on Tuesday that the coronavirus pandemic would weigh on performance.

GIC, which ranks as the world's sixth-biggest sovereign investor with $440 billion in assets, according to the Sovereign Wealth Fund Institute, joined smaller state investor Temasek Holdings in offering a bleak outlook.

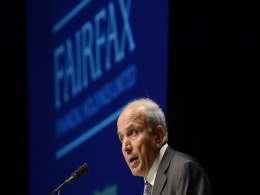

"Going ahead, it does require a lot more effort to try and generate the kind of past returns that we were able to generate," Chief Executive Lim Chow Kiat said in an interview as the fund published its annual report.

Even before the coronavirus struck, Lim said, investors were grappling with risks such as high indebtedness at companies, policy constraints and stretched valuations.

GIC reported an annualised rolling 20-year real rate of return - its main performance gauge - of 2.7% for the year to March 31, 2020, just above the figure of 2.6% in 2009.

It said the latest fall was due to the dropping out of tech-bubble gains 21 years ago from its metric and, to a smaller extent, the market sell-off over the last year. GIC reported a return of 3.4% in 2019.

The United States makes up the biggest chunk of GIC's portfolio at 34%, followed by Asia, with 32% and the Euro zone at 13%.

Lim said some companies in infrastructure, energy and financial services offered investment opportunities if they fared well in the next few years, and provided valuations were attractive.

Aided by central bank and government stimulus, global equities ended the first half on a strong note, reversing a collapse suffered in the final weeks of the first quarter.

GIC said its portfolio return was 3.9% per annum in nominal dollar terms over the five years to March 2020, versus a comparable 4.9% a year ago. That exceeded an annualised 3.3% return over five years of GIC's reference portfolio of 65% global equities and 35% bonds.

GIC's allocation to bonds and cash rose to a record 44% in the latest year from 39% from a year ago. That came at the expense of developed market and emerging market equities.

The technology sector remains key, GIC added.

"We have internally very deliberate efforts to invest in them across the whole value chain - from start-ups and all the way to mature listed, large tech companies," Lim said.