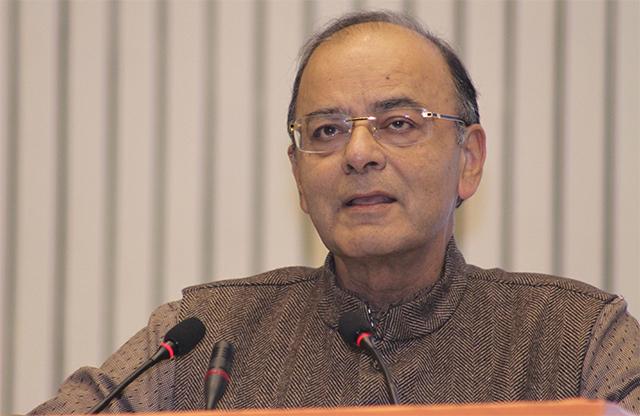

In just over a month from now, finance minister Arun Jaitley will present the annual union budget. Jaitley’s budget speech will mark two firsts: this will be the first time since independence that the union budget will be presented a month ahead of 28 February when it is normally presented (not including election years, of course, when annual budgets have followed votes on account); second, this will be the first time in almost 100 years that the railway budget will be merged with the union budget.

Budget 2017 comes following the government’s shock move to demonetise Rs 500 and Rs 1,000 notes, sucking 86% of the cash in circulation out and causing much disruption to the economy. Moreover, the Goods and Services Tax (GST) is likely to be implemented by September 2017, so the budget will have to factor in this complete overhaul in the country’s indirect tax regime.

Can Jaitley assuage the pain caused by the Narendra Modi government’s radical move? Now, budget making is a secretive exercise, and we don’t really know what’s on the finance minister’s mind, but here’s what we can possibly look forward to.

An increase in tax threshold limits: At present, the minimum tax exemption limit is Rs 2.5 lakh. Jaitley could look at raising the minimum limit and possibly resetting the tax slabs that were set several years ago. This could mean a big relief for the salaried middle classes and the upwardly mobile, who also form the Bharatiya Janata Party’s (BJP) core support base. Also in the offing could be exemptions on house rent allowance, and other sops for homeowners. The finance minister could also look at making the National Pension System (NPS) more lucrative by increasing tax exemptions.

Allowing for greater deductions under section 80C: At present, section 80C of the Income Tax Act allows for a maximum exemption of Rs 1.5 lakh, in lieu of investment. Like in the case of minimum thresholds, this limit was set several years ago. The finance minister could look at raising this limit, effectively forcing the salaried classes to save more.

Tax free infrastructure bonds: Demonetisation has meant that banks are flush with cash, which they must now deploy by lowering their lending rates. This has also meant that deposit rates too have come down, leading to a reduction in the real incomes of those who depend on fixed deposits and such other risk-free avenues of investment. Since the returns on such instruments are taxable, the real rate of return is even lower. Jaitley could bring back tax free infrastructure bonds that were a major hit in 2014-15 and are now trading on a premium on the secondary market.

Increased rural spending: If news reports are to be believed, demonetisation has hit the country’s rural economy hard, as India’s villages are almost entirely dependent on cash. The new income disclosure scheme, christened Pradhan Mantri Garib Kalyan Yojana, does say that the extra tax proceeds will go towards building schools and hospitals and creating other civic infrastructure in villages. Irrigation could be another major focus area for the government. The budget could have more sops in store for India’s rural poor, although the government does know that populist measures entail a significant cost to the exchequer.

Like this report? Sign up for our daily newsletter to get our top reports.