Fairfax India Holdings Corporation, which has just raised an additional $500 million to top up its India-focused investment corpus, has inked a deal to pick a 51% stake in Saurashtra Freight Pvt. Ltd for Rs 200 crore ($30 million), it said on Tuesday.

Saurashtra Freight is a newly incorporated firm of Saurashtra Group that has presence in infrastructure and industrials space. The company will use the money raised from Fairfax to acquire container freight station (CFS) business of a group firm Saurashtra Infra and Power Pvt. Ltd.

Saurashtra Infra runs the largest CFS at Mundra Port (Gujarat) and provides services such as moving of containers to and from the port, stuffing/destuffing of containers, cargo storage and transportation of cargo to the end customers as well as storage, maintenance and repair of empty containers.

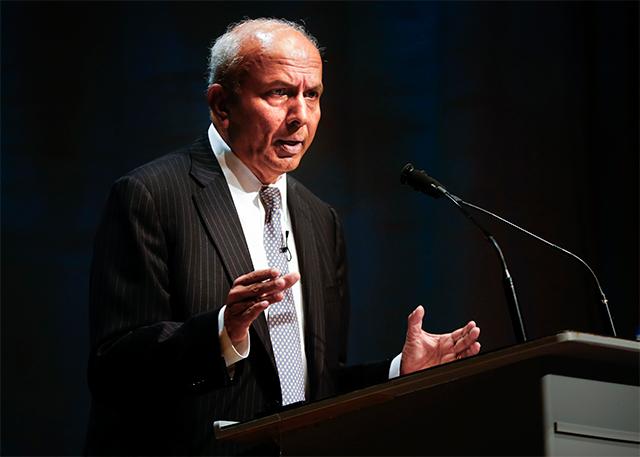

"The company is strategically located in Gujarat and caters to the fast-growing businesses in Western and Northern India. Logistics and cargo containerisation are the future of India, and will be a key enabler of Prime Minister Narendra Modi's Make in India initiative," said Prem Watsa, chairman of Fairfax India.

Raghav Agarwalla, who currently heads the shipping and logistics arms of the group, said, "Fairfax India's long-term orientation and decentralised management style will enable us to create a platform to grow the business, thus creating value for all stakeholders. We will now expand our operations at all the major ports across India and leverage our experience across new verticals in the growing logistics industry in India."

The transaction is subject to customary closing conditions and is expected to close in the first quarter of 2017.

Logistics, freight investments

Logistics business at large has been a magnet for private equity investors over the years. As India maintains its position as the fastest growing major economy in the world, despite some hiccups, logistics as the backbone of business will continue to benefit over a long term.

In the same line of business as Saurashtra Freight, a year ago, IFC invested $60 million in Continental Warehousing Corporation (Nhava Sheva) Ltd through a mix of debt and equity.

Continental Warehousing that is now in the queue to go public is backed by other PE firms including Warburg Pincus and Abraaj Capital.

In January 2016, Shapoorji Pallonji Group firm Forbes & Co Ltd also decided to sell its two container freight stations and logistics business to Transworld Group Singapore for an enterprise value of not less than Rs 93.5 crore (about $14 million).

The broader logistics segment too has seen a spate of deals.

In October, Canadian pension fund Caisse de dépôt et placement du Québec (CDPQ) said it has agreed to invest $155 million (more than Rs 1,000 crore) to acquire a significant minority stake in Chennai-based TVS Logistics Services Ltd in a transaction that will also give an exit to Goldman Sachs and KKR.

Innovative B2B Logistics Pvt. Ltd, which runs private container trains and offers warehousing services and operates under the banner of Inlogistics, is looking to raise fresh round of private equity funding and its existing investor India Value Fund Advisors (IVFA) will participate in the round.

Last march, mid-market private equity firm Ambit Pragma Ventures sold its majority stake in Pune-based Spear Logistics Pvt. Ltd to French firm FM Logistic.

Private equity firm India Equity Partners (IEP) is looking to sell its entire stake in Spoton Logistics Pvt. Ltd, formerly known as Startrek Logistics Pvt. Ltd.

In the past two years a couple of industry firms have also tapped the public markets.

Fairfax Holdings

For Fairfax India Holdings, this marks the first new deal after it raised an additional $500 million last week, which buoys its assets under management to over $1.5 billion.

The firm had almost exhausted its $1.06 billion corpus for India by investing in a bunch of companies including financial services firm IIFL Holdings Ltd, National Collateral Management Services and Sanmar Chemicals Group over the past couple of years.

The firm also has made several investments in specialty chemicals business including Privi Organics.

Last year, it signed an agreement to invest in GVK-run Bangalore International Airport. Separately, Fairfax Financial, the key sponsor and shareholder of Fairfax India, has put in more money into the country as it raised its holding in general insurance firm ICICI Lombard. Fairfax Financial also owns a majority stake in Thomas Cook, a travel and tour operator, and through it controls business services firm Quess Corp.

More recently, Fairfax Holdings received RBI approval to acquire Catholic Syrian Bank.

The $500 million fundraise has allowed Fairfax India to surpass the corpus of WestBridge Capital Partners, an Indian public equities-focused private equity firm which manages the single-largest PE fund vehicle ever created for investing in the country across sectors. WestBridge increased its corpus to $1.4 billion a little over a year ago.

Fairfax India, a PE-style investment firm, had raised $561 million more through an initial public offering to take its corpus to $1 billion two years ago.

Last year, the firm was among the Canadian firms that dominated deal making in India.

Like this report? Sign up for our daily newsletter to get our top reports.