Ozone Overseas Pvt. Ltd, a supplier of high-end architectural fittings and urban street infrastructure, is aiming to raise growth capital in a round that will also provide an exit to its existing private equity investor Everstone Capital.

The Mint newspaper reported, citing people it didn’t name, that the company is in discussions with several private equity firms to raise nearly Rs 300 crore ($45 million).

The company has hired the investment banking arm of consulting firm EY to look for potential buyers, the report said.

It couldn’t be ascertained immediately if Everstone would make a partial or a complete exit. It had put Rs 60 crore in the company in 2011.

Email queries to Ozone and EY didn’t elicit any immediate response. Everstone declined to comment.

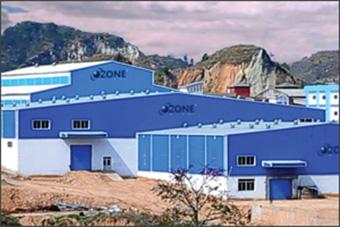

Ozone has manufacturing units in Himachal Pradesh and China. It has two subsidiaries, Ozone Architectural Products, which makes stainless steel architectural products, and Ozone Matrix Infracon, a provider of consulting, design and construction services.

As per its website, the company has offices in India, Canada, Australia, and Dubai and distributor networks in Poland and Saudi Arabia. The company competes with the likes of Neki India, Dorma India Pvt. Ltd and Kich Architectural Products Pvt. Ltd.

Everstone’s exits

Everstone Capital, which is also the largest private equity investor in restaurants business in the country with several chains under multiple firms and brands, is looking to sell its entire stake in Pan India Food Solutions Ltd.

Last year, Everstone had struck an exit through the strategic sale route. It sold its stake in Ravindranath GE Medical Associates Pvt. Ltd, which runs a super-specialty care and multi-organ transplantation hospital chain under the Global Hospitals brand, to Malaysia's IHH Healthcare Bhd.

The PE firm is also looking to part-exit in the proposed IPOs of VLCC and Hinduja Leyland.

In September last year, Everstone made the final close of its third sector-agnostic but consumer-themed fund, Everstone Capital Partners III LP, at $730 million, the third largest sector-agnostic PE fund ever raised for India.

Like this report? Sign up for our daily newsletter to get our top reports.