2015 has been a stellar year for Indian Start-ups by every yardstick. The Year witnessed US $5 billion of total funding in Start-ups with 3 more companies entering the billion dollar ‘Unicorn’ club. Continuing the momentum, the year 2016 has already witnessed 1 more unicorn, bringing the total to 9 unicorns in India. Global trend has been no different with 81 new entrants to the Unicorn club, including one Decacorn, this year.

Let’s flip the coin for a 360-degree view. 75% of unicorns globally have not yet exited. Last year, 3 acclaimed global Unicorns saw a significant correction in their Valuations compared to their last round Valuation (1 Company got listed at a lower Valuation and the other 2 were pragmatic realizations by Private Investors).

The dichotomy clearly suggests that nothing is invulnerable. Amidst all the momentum and hype, the general tendency is to ignore the details. It is crucial to understand the key terms, decipher these high Unicorn Valuations and why the Private IPO ‘universe’ cannot be compared with Public (IPO) valuations. To put things in perspective, we analyzed 8 Product focused Indian Unicorns.

Opening Pandora’s Box

I. First Look

1. All 8 Unicorns were led by non-traditional VCs (Hedge Funds, Corporate Investors or Sovereign Wealth Funds) in the Unicorn round

2. The Average Valuation of companies analyzed was $4.1 billion; the median valuation was $2.3 billion

3. Across all 8 Unicorns, the Average increase in Valuation from the last financing round was over 175% wherein the companies just entering the Unicorn club registered an Average of over 230% increase

Analysis

- Achieving Unicorn Valuation and negotiating the same (rather than Terms) appears to be the goal of these companies

II. Digging Deeper

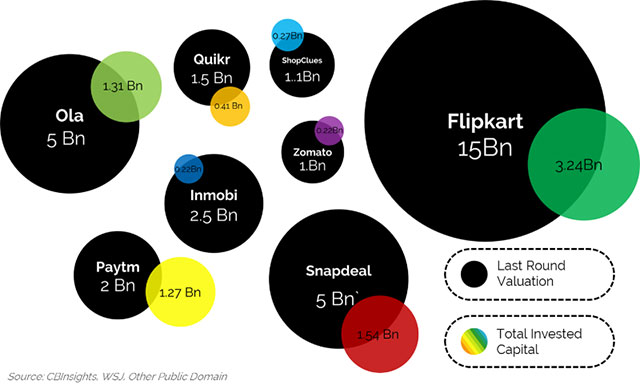

1. As depicted above (in USD), majority of the Unicorns have a significant gap between total funding raised and last round valuation

2. For illustration, 8 Indian unicorns have an aggregate valuation of $33 billion and an aggregate funding amount of $8.5 billion. With investors’ liquidation preference, valuations of these companies will have to fall on an average by more than 250% before the Unicorn investor would suffer a loss on their investment. With senior liquidation preference over other preferred stock holders, unicorn investors can get further leverage

Analysis

- Terms (such as Seniority and Liquidation Preference) and the significant delta between funding and valuation provide a fair amount of downside protection for Unicorn Investors’ investment, especially in the event of an acquisition

III. Looking Under The Hood

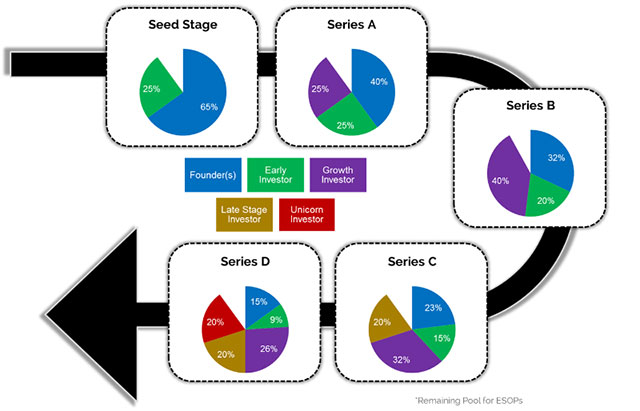

1. Based on industry assumptions, we worked out an illustrative Cap table flow (shown above) of a Unicorn Company which shows significantly diluted position of the Founders

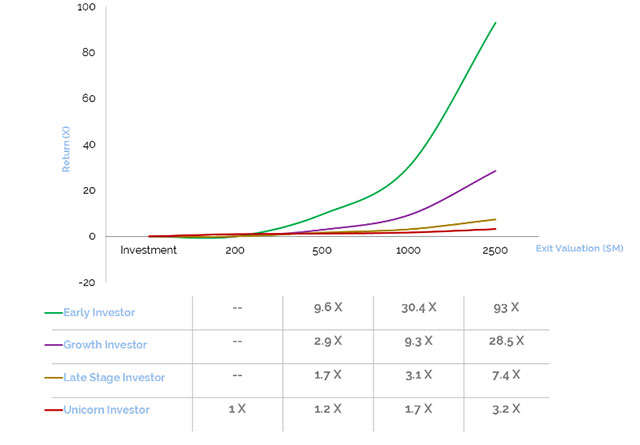

1. Potential Exit returns under various Exit Valuation scenarios (as shown above) clearly shows that the Unicorn Investors (because of the high Valuation entry) will be motivated only to sell at significantly higher Valuations while Early and Growth Investors may find Exits attractive even at relatively lower Valuations

2. The Unicorn Investors would remain impassive between $200M and $1000M Exit valuation whereas the Other Investors will have contrasting opinion

Analysis

- A Liquidity event in Stacked Liquidation Preference structure poses a potential conflict of interest between Founders / Early / Growth investors and Unicorn Investors

“If it sounds too good to be true, it probably is”. Our recommendations to entrepreneurs are as follows;

Terms are Vital - It is critical for Entrepreneurs to understand, take a longer view and negotiate proper positions on all the key terms and not just look through the prism of Valuation

Justify and Sustain Your Valuation - Higher the valuation, higher would be the delta of value you need to create before every new financing

Focus on Building Sustainable Business - A Right Valuation is important but a strong grip and a firm eye on sustainability & unit economics profitability is even more critical

As a team, we respect every Entrepreneur’s dream for his or her Company and certainly consider Growth/Momentum as one of the important metrics. That said, we sincerely believe that ambitious yet pragmatic teams with a vision for long-term impact and sustainable business go a long way in creating value all and sundry.

Abhishek Srivastava is a director at Endiya Partners.