Over the past decade, India has seen an increase of nearly 350% in the number of Ultra High Net Worth Individuals (UHNWIs), or people with investible assets of $30 million or more. At last count, India had more than 6,200 such individuals, a significant number of whom have taken to investing in the art market.

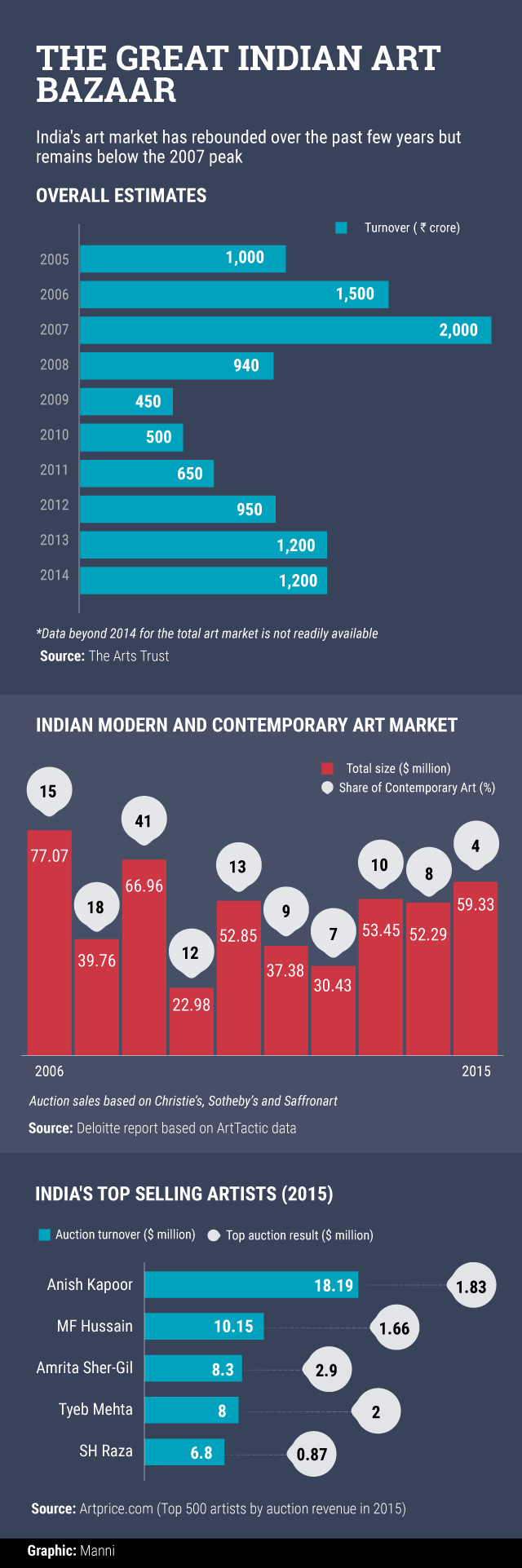

This has helped the Indian art market grow steadily since 2009, when, following the global financial crisis of 2008, it had shrunk to a mere Rs 450 crore. Still, at around Rs 1,200 crore (as of 2014), India’s market is nowhere close to the levels it had attained in 2008, just before the crash.

However, a recent report by financial consultancy Deloitte said that more than half the experts surveyed believed the art market will see an upswing during 2016-17, especially with Indian sales shifting from auctions in New York and London to Indian cities.

A 2015 report by French art market database Artprice.com said that India was the 12th largest art market on the global map, and had seen a triple-digit increase in turnover during 2015. “The more its market becomes international, the stronger it gets,” the report noted.

“The secret to India’s triple-digit turnover growth ($48.9 million, up 112% versus 2014) is partly related to the confidence instilled by Christie’s opening a branch in the country,” the report said. “After its inaugural sale in December 2013, it held its third sale in Mumbai on 15 December 2015 which generated nearly a third of the country’s annual turnover.”

At least five Indian artists (present and past)—MF Husain, SH Raza, Anish Kapoor, Amrita Sher-Gil and Tyeb Mehta—figure among the top 500 global artists by sales in 2015.

Like this report? Sign up for our daily newsletter to get our top reports.