The Finance Minister (FM) presented the India Union Budget 2009 in Parliament today against the backdrop of a slowing economy in which the Gross Domestic Product growth rate has decreased to 6.7 percent in financial year 2008-09 from 9 percent levels. This seems to be the roadblock which has curtailed the maneuverability for tax sops to a large extent. Foreign Institutional Investors are the key drivers of the Indian stock markets since the opening up of the investment sector in India. The income-tax proposals in the Union Budget for FIIs are keenly watched by all. The direct tax proposals in the Union Budget 2009 impacting FIIs are summarized below.

Securities Transaction Tax

There was an expectation that the FM would reduce, if not waive, the Securities Transaction Tax (STT), a tax levy on transactions in securities carried out through Stock Exchanges. However, the FM has not proposed any amendment to the STT, but has proposed to abolish the Commodities Transaction Tax, a tax levy on commodity derivative transactions carried out on the Commodity Exchanges, with effect from April 1, 2009. Foreign Institutional Investors (FIIs) are presently not permitted to invest in India in commodity derivatives.

Surcharge

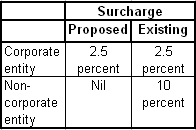

The FM has proposed to withdraw the levy of surcharge on non-corporate entities. The current and proposed levy of surcharge on income-tax is as under:

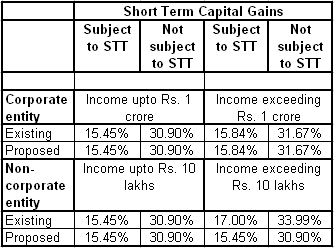

The new effective tax rates applicable to corporate and non-corporate FIIs on short term capital gains income for financial year 2009-2010 will be as under:

Non-corporate FIIs will now have to pay tax on short term capital gains 15.45 percent instead of 16.995 percent. FIIs will be able to continue to enjoy tax free long term capital gains where STT has been paid.

Advance tax

The liability for payment of advance tax is triggered where the tax liability exceeds Rs 5,000 in a financial year. The trigger limit for advance tax liability is proposed to be increased to Rs 10,000 in a fiscal year.

Minimum Alternate Tax

Under the existing Minimum Alternate Tax (MAT) provisions, a corporate entity is liable to tax at the rate of 10% of book profits if the income-tax computed under the other provisions of the IT Act is less than such minimum. The MAT rate is proposed to be increased to 15% from 10% of book profit. Tax paid under MAT provisions is allowed to be carried forward and set off in subsequent seven assessment years to the extent of the difference between the tax under MAT provisions and tax computed as per other provision of the Act. The period of carry forward is proposed to be increased from seven to ten assessment years.

Public float of listed company

While delivering the Budget speech in Parliament, the FM proposed to increase the threshold for non-promoter public shareholding for all listed companies in a phased manner as the average public float is less than 15 percent. This should bring cheer to the FIIs as there would be opportunity to invest in more companies with the increase in public float.

Zero coupon bonds

The FM has proposed to allow scheduled banks including nationalised banks to issue zero coupon bonds to source their long term funds. FIIs investing in debt would be able to invest in such zero coupon bonds issued by scheduled banks including nationalised banks.