Workday, Inc., a cloud-based business software company co-founded by PeopleSoft’s Aneel Bhusri, which raised over $600 million in its IPO continued to see its shares pop up at NYSE on its third day giving it almost twice the market cap it sought in the public issue.

The company’s share price was up again on Day 3 after notching huge gains since listing last Friday. The shares were quoting at $52.73 a share, up 1.5 per cent 10.36 AM (EDT) on Tuesday as against the IPO price of $28 a share. At the current market price the company commands a market cap of $8.4 billion.

The stock price rose 74 per cent to close on Friday at $48.69, the fifth-biggest percentage gain on the first day of trading for any IPO this year.

Workday also happened to be the biggest IPO in the US since Facebook’s hyped public issue, which cooled off after initial euphoria.

Founded in 2005, Workday provides enterprise cloud applications for human resources and finance. It offers Human Capital Management, Financial Management, Payroll, Time Tracking, Procurement, and Employee Expense Management applications to companies. Its customers are spread across education, financial services, healthcare, manufacturing, hospitality etc. The company counts among its clients Yahoo!, Symantec, Aviva, Brown University, CareFusion, H.B. Fuller etc.

The California-based firm, which helps companies keep financial details contained in IPO documents private for longer, applied for IPO in July.

Workday had raised $250 million from venture capital firms and other investors, including Greylock Partners, New Enterprise Associates, T Rowe Price, Morgan Stanley Investment Management, Janus Capital Group Inc and Amazon CEO Jeff Bezos.

Workday was co-founded by David Duffield and Aneel Bhusri -- former PeopleSoft executives who left the company after it was snapped by Oracle around eight years ago. Bhusri is also chairman and co-CEO of the company.

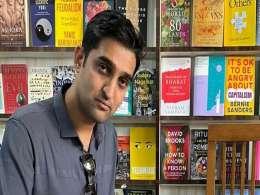

Aneel Bhusri:

Bhusri an Indian-American has been a techpreneur and venture capitalist building his name specially in the cloud domain.

The electrical engineer with an Economics degree started his career at Morgan Stanley and went on to add an MBA Degree from Stanford. Thereafter, he began his career in the technology field when PeopleSoft was an upcoming firm, straddling several roles including SVP Product Strategy & Marketing besides serving as the vice chairman for five years until the hostile takeover of the firm by Oracle in 2004. Feted as a product innovator he joined hands with his former colleague to start Workday.

Bhusri is also active venture capitalist working as a partner at Greylock Partners. He has been particularly associated with investments in cloud technologies, with an emphasis on applications, data center infrastructure and middleware.

Most recently, he was the lead investor and chairman of Data Domain, a leading storage provider that was acquired by EMC for $2.4 B in 2009. He was also an investor and board member of Outlooksoft (acquired by SAP), Polyserve (acquired by HP) and Perfigo (acquired by Cisco). In addition to Workday, he currently serves on the boards of Cloudera, Drobo, Okta, Pure Storage, and T.

In addition, Bhusri has also invested in firms like ServiceNow (another enterprise tech firm which went public soon after Facebook), Zuora (cloud service involving invoicing and billing) and Pure Storage (enterprise storage systems).

(Edited by Prem Udayabhanu)